Both the number of VC deals and the total VC investment in Europe fell for the fourth straight quarter, dropping from $15.7 billion in Q4’22 to $9.8 billion in Q1’23. The decline was particularly stark when set against the record number of VC deals and VC investment seen during the same quarter in 2022.

VC investors more stringent with portfolio companies

VC investors in Europe were increasingly cautious in Q1’23, taking a heavier hand with their portfolio companies—scrutinizing their internal budgets, pressuring them to cut costs and become more efficient, and holding them accountable to agreed-upon milestones. Over the next couple of quarters, VC investors could begin to pick and choose between their portfolio companies, pulling back from making follow-on investments in companies they don’t believe can survive. This could spur M&A activity as startups look to sell in order to avoid failing.

Governments enhancing supports for startups

Several government-backed initiatives were initiated in Europe during Q1’23 to support startup growth. The UK’s budget included £3.5 billion to help the country become a scientific and technologic superpower, including funding to support next-gen supercomputing and AI research1. The UK also released a whitepaper on the regulation of AI2. During the quarter, the German government also launched a €1 billion fund to support growth stage deeptech and climatetech companies3, while the European Investment Bank Group and five EU member states announced the European Technology Champions Initiative: a $3.75 billion fund to address funding gaps and support late-stage growth companies in the region.

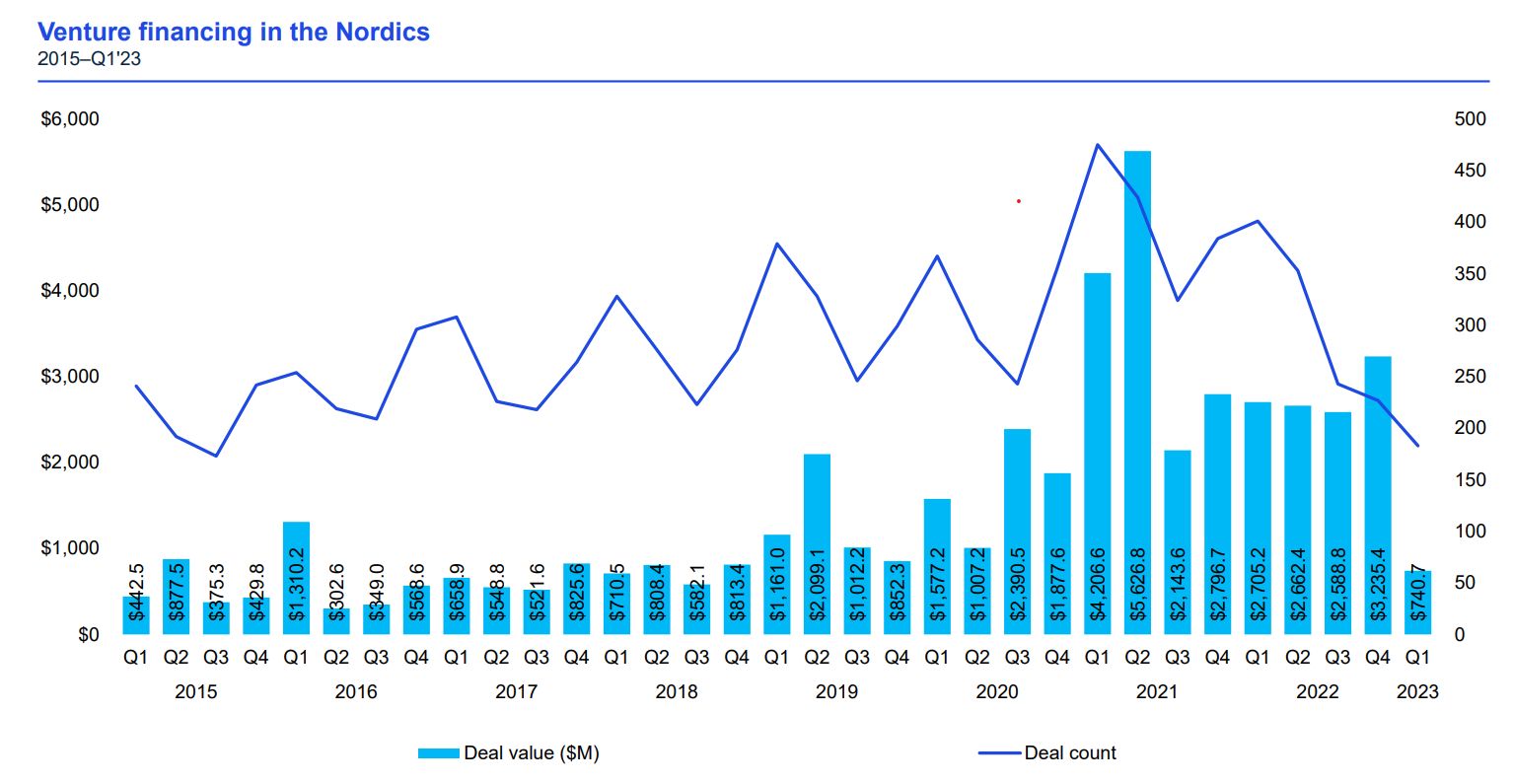

Nordics region has quiet start to the year

Q1’23 was a very quiet quarter of VC investment in the Nordics. Denmark-based biotech company Hemab Therapeutics’ $135 million raise was the largest round of the quarter, highlighting the growing biotech sector in the region. Other VC deals during Q1’23 were much smaller—primarily under $20 million—as less International late-stage investments occurred and local investors completed primarily smaller early-stage deals.

We’re not seeing many companies raising growth rounds at the moment in the Nordics. The environment is far too uncertain for them. In fact some are deferring any new equity rounds until late this year or into 2024. There’s more rounds being raised at the early stages here right now — although also the deployment of capital for early-stage companies slowed down somewhat in Q1’23.

Trends to watch for in Q2’23

Q2’23 will likely be another challenging quarter for VC investment in Europe, given the unrelenting amount of uncertainty permeating the market. Traditional VC investors will likely remain cautious, scrutinizing deals carefully to assess whether business models will be resilient, while also putting more pressure on their portfolio companies to cut costs. Some well-capitalized corporates may start to see the current environment as an opportunity rather than a challenge, particularly when it comes to making acquisitions. Non-core carveouts and bolt-on deals could also increase. Should market challenges intensify over the next few quarters, governments in Europe could step up their supports for startups.