VC investment in Europe plummeted to a two-year low in Q4’22, amidst an environment of high inflation, rising interest rates, the ongoing war in the Ukraine, and skyrocketing energy prices. Compared to recent quarters, the largest deals in Europe during Q4’22 were substantially smaller — although still sizeable and geographically diverse — led by 3 deals in the electric vehicle and mobility ecosystem - a $500 million raise by Sweden-based Einride, a $295 million raise by Sweden’s Volta Trucks and a $245.9 million rase by French battery producer Verkor.

VC investors in Europe prioritizing companies in their own portfolios

During Q4’22, VC investors across Europe showed increasing caution, putting a significant amount of pressure on their portfolio companies to cut costs and reduce their spend. While mature startups undertook the most publicised cost-cutting measures in Europe during the quarter, primarily major headcount reductions and reductions in real estate, the later part of Q4’22 saw a wave of smaller VC backed startups starting to follow suit.

Average Seed stage deal size in Europe grows significantly in 2022

Over the course of 2022, the average Seed stage deal size in Europe soared quite significantly as US investors found real value in European companies. US investors in the region typically invested larger amounts into deals than their European counterparts because of the comparatively low valuations of companies to be had in Europe. The declining value of the Euro against the US dollar also offered a unique opportunity for US investors to buy European companies at very reasonable prices.

Energy crisis creates VC market winners and losers

The ongoing energy crisis in Europe continued to put a major spotlight on companies operating in the renewable energy and energy storage spaces, spurring strong investment in a wide range of companies. In addition to the large raise by Verkor, Estonia-based renewable energy infrastructure company Sunly raised $196 million, Belgium-based hydrogen energy company Tree Energy Solutions raised $128 million, and Norway-based renewable energy financing company Empower New Energy raised $74 million.

Europe also saw significant investments in ESG and energy-adjacent businesses during Q4’22, including a $113 million raise by Norway-based Reetec—which manufactures minerals used in EV motors and wind turbines in an environmentally sustainable way.

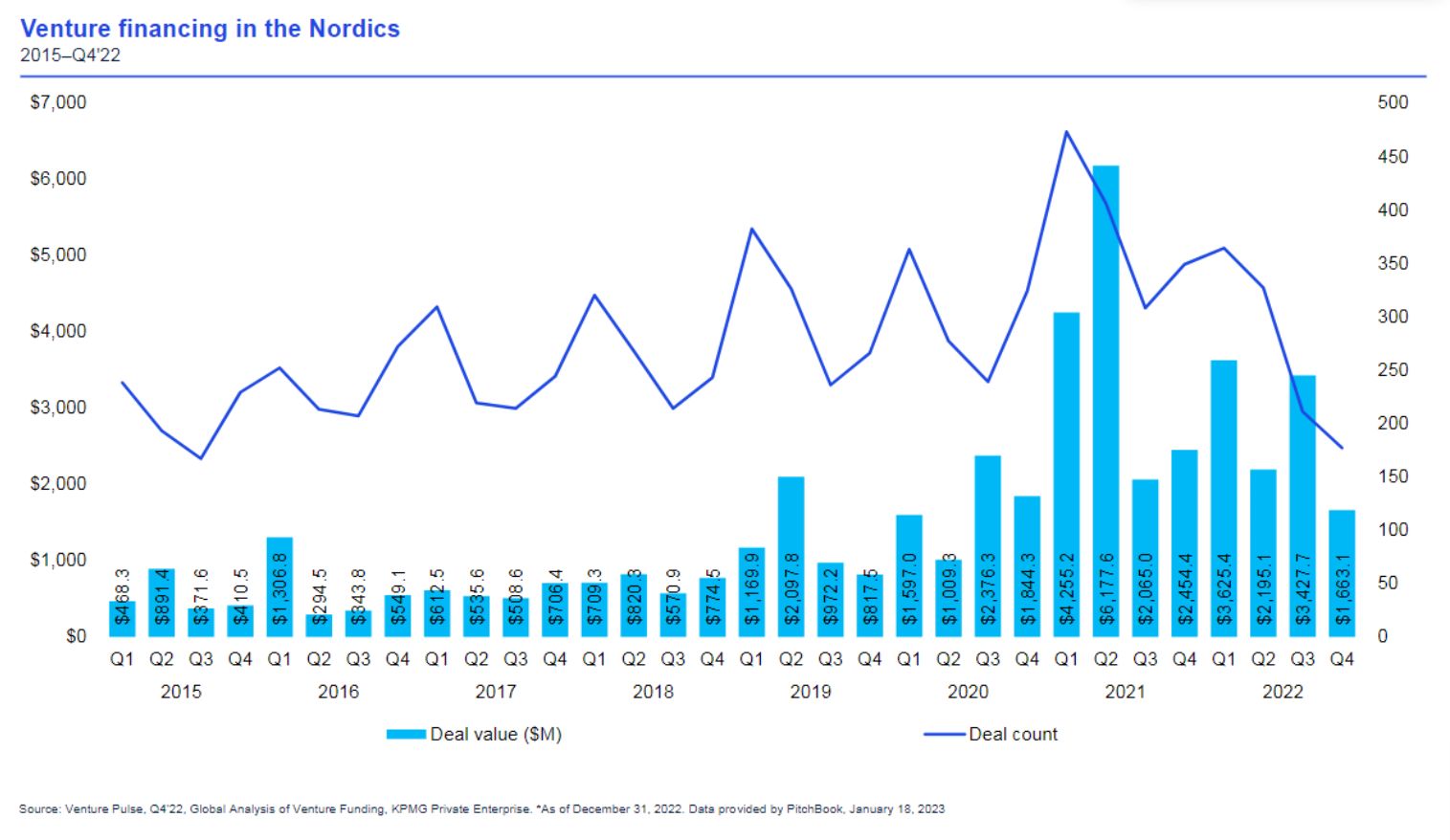

Nordics region remains attractive to VC investors in Q4’22

The Nordics region continued to attract solid interest from VC investors in Q4’22 in terms on deal value, most prominently in the energy and electric vehicle space, despite a drop in total VC investment. In addition to Sweden’s Einride ($500 million) and Volta Trucks ($295 million), Norway-based food delivery platform Oda raised $151 million—although the latter was at a substantially lower valuation than the company’s previous funding round. Trends in the Nordics region are lagging a bit behind vs. for example the US. This could result in softer investment in Q1’23 as the VC market in the region sees more impact from the global downturn and the runways of the companies start to shorten.

Q4’22 was quite reflective of the VC market in the Nordics region historically with a handful of bigger growth rounds. This was a bit surprising, but the VC market here often lags a bit behind the US trends-wise, so Q1’23 could also show more of a freeze in growth rounds. That said, there shouldn’t be much of a drop in first financings because there are quite a lot of rather fresh local pre-seed/seed funds and the valuations on this stage haven’t been as high as elsewhere.

Trends to watch for in Q1’23

Looking forward to Q1’23, VC investment in Europe is expected to remain relatively soft, with no end in sight to many of the challenging factors affecting the VC market. While many sectors will likely face challenges over the next quarter, VC investment will likely continue apace in high priority areas, including energy, energy security, and ESG. While interest over the near-term is expected to focus on energy independence and energy alternatives, interest in cleantech will likely accelerate as countries in the region work to meet their decarbonization targets.

Interest in lending solutions could also pick up as companies struggle to access cash and startups look for innovative options to avoid down rounds.