Europe saw VC investment fall to its lowest level in seven quarters during Q3’22, amidst continued geopolitical uncertainty, inflationary pressures, and rapidly rising interest rates. Rapidly rising energy costs, concerns about a potential recession, and the ongoing war between Russia and the Ukraine also had a major impact on investor sentiment and VC funding in the region.

B2B and energy attract big funding rounds in Europe

B2B-focused companies attracted major interest from VC investors in Europe during Q3’22, led by a $1.4 billion raise by Germany-based business productivity firm Celonis. Given the very real energy crisis in Europe exacerbated by the Ukraine conflict, interest in alternative energy and energy storage was also very high. The sector attracted a number of large deals, including a $1.1 billion raise by Sweden-based Northvolt—the second largest raise of the quarter in the region.

VC investment in cybersecurity sector remains hot

While a number of sectors saw declining investment in Europe during Q3’22, VC investors continued to show strong interest in cybersecurity. Companies focused on managed services were particularly attractive to VC investors, in addition to those focused on helping companies consolidate their ability to identify, address, and manage cyber threats and concerns.

Israel continued to be a strong hub for cybersecurity investment in Europe, with network management companies Talon and Cymulate raising $100 million and $70 million respectively during Q3’22.

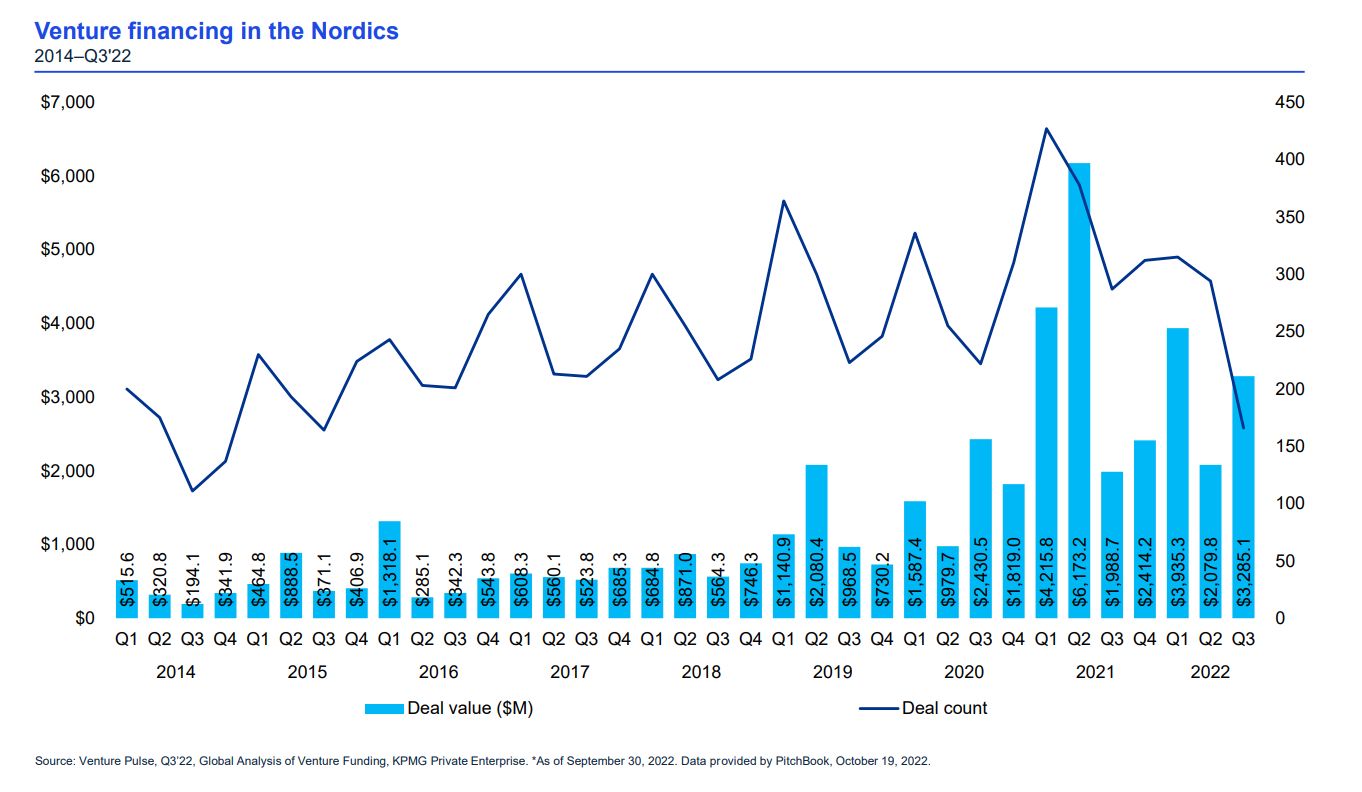

Nordic region bucks downward investment trend, driven by Northvolt and Klarna raises

Within Europe, only the Nordic region showed an increase in funding quarter-over-quarter, propelled primarily by two large deals: a $1.1 billion raise by battery maker Northvolt and an $800 million raise by buy-now-pay-later company Klarna. While VC investment in the Nordic countries remained robust, the number of deals dropped considerably in Q3’22. This highlights the growing polarization of funding in the region, with the strongest companies able to attract investment while others fall by the wayside.

Despite the degrading market conditions globally, the Nordics region continued to see strong fundraising activity in Q3’22. During the quarter, EQT Growth closed a $2.4 billion fund to support European growth startups, while Northzone announced a $1 billion fund focused on both Europe and the US markets.

In the Nordics, we've seen a lot of new early-stage funds raised over the last five years. There are quite a lot of fund managers who have already raised second funds with current drypowder. The challenge in future will be how many will be able to raise a third fund? The third fund can be kind of a make-or-break point for fund managers as they need to be able to show more returns from exits of their previous funds. This is going to be one area to watch moving forward as it will be critical for the longer term maturation of the early-stage VC market here.

PE firms make foray into debt financing as companies look to debt options

Over the last quarter, debt financing gained new attention in Europe as large PE firms made forays into offering lending products to startups. With interest rates rising, such activity will likely step up considerably as finance providers consider getting back into the debt market due to the improving possibility of returns. During Q3’22, Ireland-based Wayflyer announced that it had secured a $253 million debt financing facility from Credit Suisse in order to expand and scale their lending offerings to startups.3

Trends to watch for in Q4’22

With geopolitical and macroeconomic uncertainty expected to continue, VC investors in Europe will likely become even more aggressive in their investment decision making heading into Q4’22. early-stage companies could feel the biggest impact, which could hinder the health of the deals pipeline long-term.

Energy and ESG are expected to remain hot areas of investment in Europe heading into Q4’22, particularly as they relate to alternative energy and battery storage. B2B is also expected to remain very attractive to investors, particularly as companies across the board focus on improving efficiencies and enhancing their profitability.