KPMG Nordic Private Equity Data Snapshot, November 2019

KPMG Nordic Private Equity Data Snapshot, November 2019

Nordic PE deal volume rides a twin peak

Nordic PE deal volume rides a twin peak

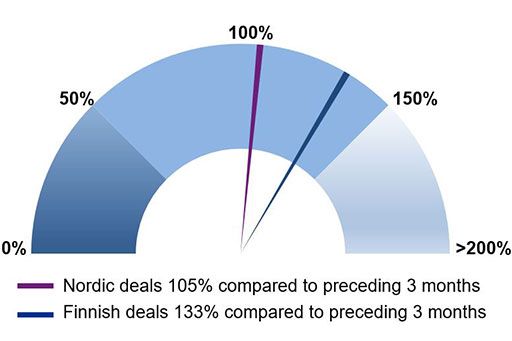

Last 3 months Nordic and Finnish Buyout and VC deal activity compared to preceding 3 months

Deal activity

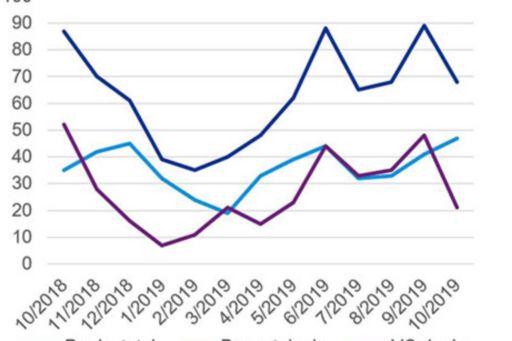

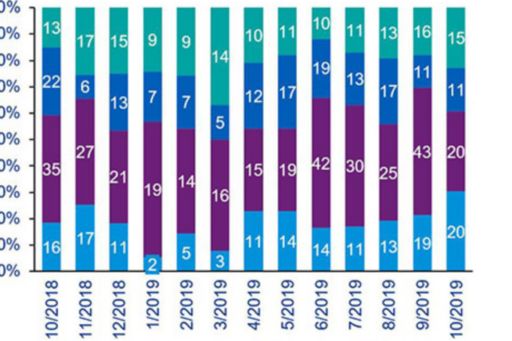

The Nordic PE monthly deal volumes are bouncing back and forth, although the lows are now staying at a higher level compared to the first half of the year. Compared to previous year the volumes are roughly at the same level. A year before the trend was clearly downwards, bottoming in March 2019.

Finnish deals peaked in October, boosting the 3 month Finnish rolling deal amount and contributing strongly to the Nordic deal count. Swedish deals declined significantly in October compared to the previous month, which included an exceptionally high number of accelerator / incubator program deals. The decline in the Swedish VC deals had an impact on the Nordic deal volume levels.

Monthly Nordic Buyout and VC deal volume

Fundraisings

GRO Capital, a Danish mid-cap PE fund, announced final close of its GRO Fund II at EUR 255M on October 8, surpassing the target of EUR 250M. The fund is focused on B2B software, targeting leading software companies with momentum in Northern Europe. Fund II is already 30% invested between two platform investments.

Monthly Nordic Buyout and VC deal volume

Deal picks of the month

Nordic Capital announced on October 15 an agreement to acquire iLOQ from Sievi Capital and other shareholders. iLOQ is a leading provider of self-powered digital and mobile locking systems with a revenue of EUR 50M in 2018. The transaction, which is subject to the approval of the necessary competition authorities, is expected to close by the end of 2019.

Canatu, a developer of 3D formable and stretchable films and touch sensors raised EUR 15M of venture funding in a deal led by Denso on October 31. 3M Ventures, Faurecia and other undisclosed investors also participated in the round.

Juuri Partners Oy along with management of LeadCloud, a cloud-based integration platform acquired a majority stake in the company. LeadDesk Plc remains a minority shareholder in the company. Concurrent to this transaction, LeadCloud has acquired the data business of Fonecta, a Triton’s portfolio company.

Kenneth Blomquist

Partner, Advisory

KPMG in Finland