KPMG Nordic Private Equity Data Snapshot, August 2019

KPMG Nordic Private Equity Data Snapshot, August 2019

Summer vacation mode in PE deals in July after a busy June

Summer vacation mode in PE deals in July after a busy June

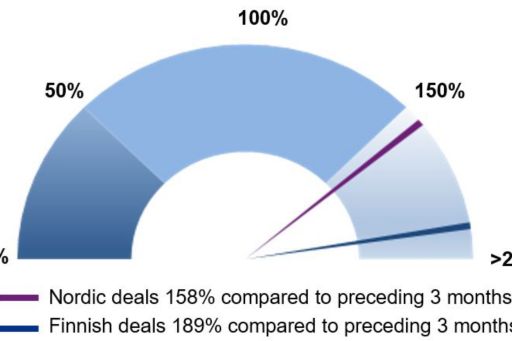

Last 3 months Nordic and Finnish Buyout and VC deal activity compared to preceding 3 months

Deal activity

Overall deal activity level in Finland and also in the Nordics declined significantly in July from the June’s peak levels of 2019. However, the three month relative deal activity remains still on the growth path for both Finnish and Nordic deals, due to the slow first half of the year.

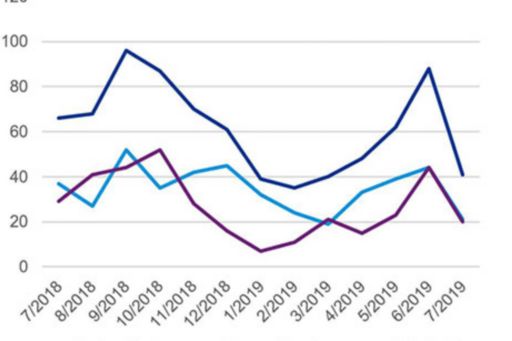

Both the buyout and venture capital deal volumes on a Nordic level declined in July together with the total deal volume.

Significant amount of recent deals were recorded to the database after the publication of our June Snapshot. We have adjusted the June deal volumes accordingly.

Monthly Nordic Buyout and VC deal volume

Fundraisings

Norwegian life science focused venture capital firm Hadean Ventures had final closing for its first fund Hadean Capital I at EUR 71m on July 6. The fund is backed by leading private and institutional investors including Saminvest and Argentum. Hadean Ventures invests in life science companies across Europe with a particular focus on the Nordic region.

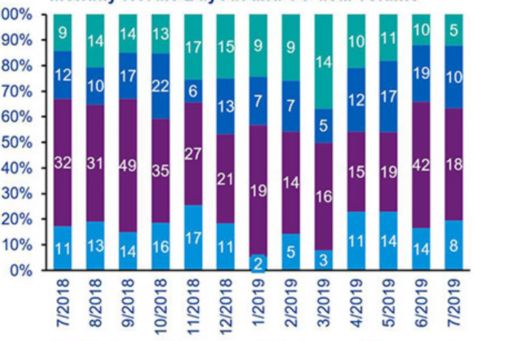

Monthly Nordic Buyout and VC deal volume

Deal picks of the month

Elenia Oy has agreed to sell its district heating business, Elenia Heat, to SL Capital Infrastructure II SCSP, DIF Infrastructure V Coöperatief U.A. and LPPI Infrastructure Investments LP. Elenia Heat is the owner and operator of 16 local district heating networks across Finland.

IQM Finland, developer of quantum computers, raised EUR 11.6 million seed funding from Finnish Industry Investment, QED Investors, Matadero Capital and Vito Ventures. Maki.vc, OpenOcean and MIG Fonds also participated in the round. The funds will be used to speed up advancements in quantum computing.

Triton Partners has acquired a majority stake in Stockholm-headquartered healthcare provider Aleris from Investor AB subsidiary, Patricia Industries, at an enterprise value of SEK 2.8bn (EUR 266m). The transaction is subject to regulatory approval and is expected to complete during the third quarter of 2019.

Danish buyout firm Axcel Management has acquired Copenhagen-based gaming accessories manufacturer SteelSeries from private equity firms L Catterton and ClearVue Partners. The transaction values SteelSeries at DKK 2bn (EUR 268m).

Kenneth Blomquist

Partner, Advisory

KPMG in Finland