Organisational culture seems to come under increasing scrutiny from various lenses, particularly regulators. It’s an area some firms seem to struggle to get right.

Culture is, of course, a very broad term. A word meaning different things to different people – it can be hard to describe exactly what the term ‘culture’ really means. In this way, culture can also be difficult to manage, monitor, and control. Yet without a positive culture – an organisation will likely struggle in different areas.

Every firm has its own distinct culture and way of operating – usually set and driven by its board and senior management. A firm’s culture will undoubtedly play a big part in the approach adopted to engaging and complying with regulatory obligations.

Following the major corporate scandals of the early 2000s and the aftermath of the 2008 financial crisis, firms put in place policies and controls to avoid repeat failings, usually at great expense. Despite this, sometimes the effort and spend involved didn’t achieve a meaningful transformation in corporate behaviour – its effectiveness was persistently undermined by cultural failings.

Of course, there’s always a cost attached to trying to change corporate culture. In a global environment of rising costs, it’s easy to understand why ‘soft controls’ such as culture can be overlooked.

Culture has in the past had limited attention from both firms and regulators. However this is no longer the case, as evidenced by recent action taken by global regulators where culture appears to be a recurring theme.

So what is culture and why does it matter?

The Cambridge dictionary defines culture as “the way of life, especially the general customs and beliefs, of a particular group of people at a particular time”. In business we tend to think of culture as a firm’s core values and principles. These include its behaviours and goals, its integrity and the way its people operate, having regard to the spirit, as well as the letter of the law.

Culture matters. Not only because it’s about doing the right thing, but a positive workplace culture impacts so many other areas within a firm. It can often be a difficult balance to get right, and yet it is so important.

No one wants to have a blame culture within their firm, nor one where people are afraid to make decisions. Instead, firms should have a culture that empowers their staff, drives engagement and compliance, and with that – performance.

We often hear the phrase ‘tone from the top’ within the business world. But when it comes to culture – what does that really mean?

It means effectively embedding clear cultural goals throughout an organisation, and driving those goals forward. Supporting commitment to areas such as human resources by making sure the firm has the appropriate number of staff in place, and – more importantly – making sure they are trained properly and aware of the firm’s policies.

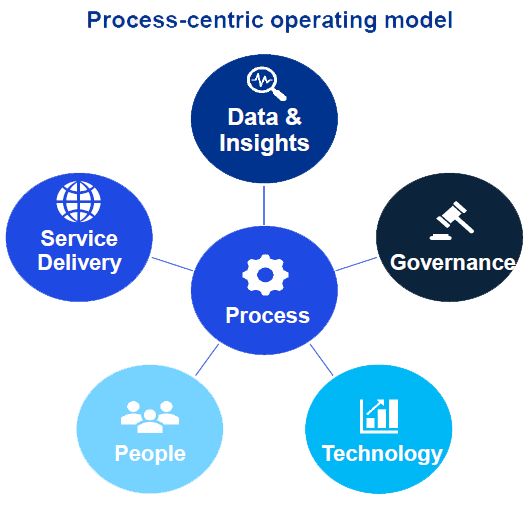

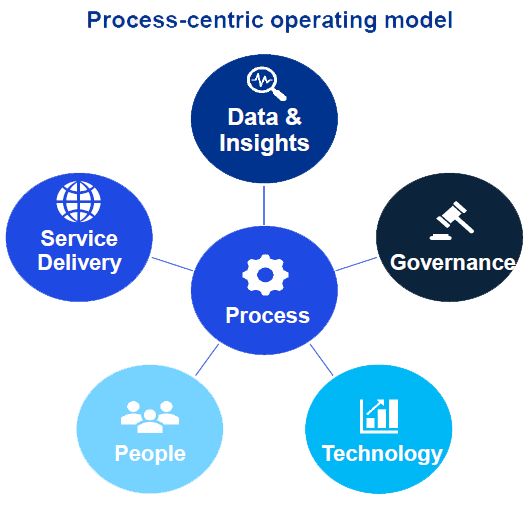

Having the right regulatory framework in place is crucial in demonstrating compliance with regulatory obligations. Firms should have clear policies and procedures available to their staff, but more importantly, they should make sure staff apply them on a day-to-day basis.

When it comes to systems – use them appropriately and to their full potential. Make sure they produce the right data which demonstrates how the firm is performing, but also ensure there is technology support in place for when things don’t go to plan.

There should be comprehensive and consistent reporting to the board, produced timely and regularly. This will enable issues to be raised, and appropriate decision-making and action being taken.

When there are cultural issues, the impact can be significant. Not only for the firm itself, but also for the jurisdiction in which it operates.

What else can firms do to promote the right culture?

In addition to the above driven by the board and senior management, there has also been more recent focus on what is coined the ‘mood in the middle’. This is when the firm’s expected culture has embedded itself into the middle and lower management of a firm, for them to drive forward with more junior staff.

When it comes to controls – every department should commit to the effectiveness of controls within their area. This includes regular reporting to the board / senior management where appropriate. There should be effective measuring and monitoring on areas of culture and transparent conduct, collaboration between departments, and consideration toward the interests of all stakeholders when it comes to decision-making.

All staff should be accountable for their decisions. A strong culture encourages issues to be openly discussed but ensures clear consequences for blatant breaches of risk appetite or policy – particularly for financial purposes. Without a culture of openness, behaviours can be skewed and ineffective decisions can be repeated over time. Incentives can also skew actions, and firms should apply a risk-adjusted framework that clearly links risk performance and reward.

What are the advantages of getting the firm’s culture right?

There are many benefits to a firm getting their culture right. Not only is the risk of misconduct and potential regulatory action reduced, but the firm’s reputation is also enhanced with the people who matter most; its clients, employees, shareholders, and regulators. The right culture helps firms attract and retain the right staff, increases customer satisfaction, drives performance, and promotes innovation. This ultimately protects the lifetime of a firm’s brand.

How can KPMG help?

KPMG has developed tools to measure employee engagement and identify organisational culture. We focus on providing businesses with a holistic snapshot of how a workforce views its organisational culture – bringing together quantitative, qualitative, and advanced statistical data analysis. This enables you to not only hear the voice of your employees, but also identify critical demographic groups who may pose a greater retention risk compared with other colleagues.

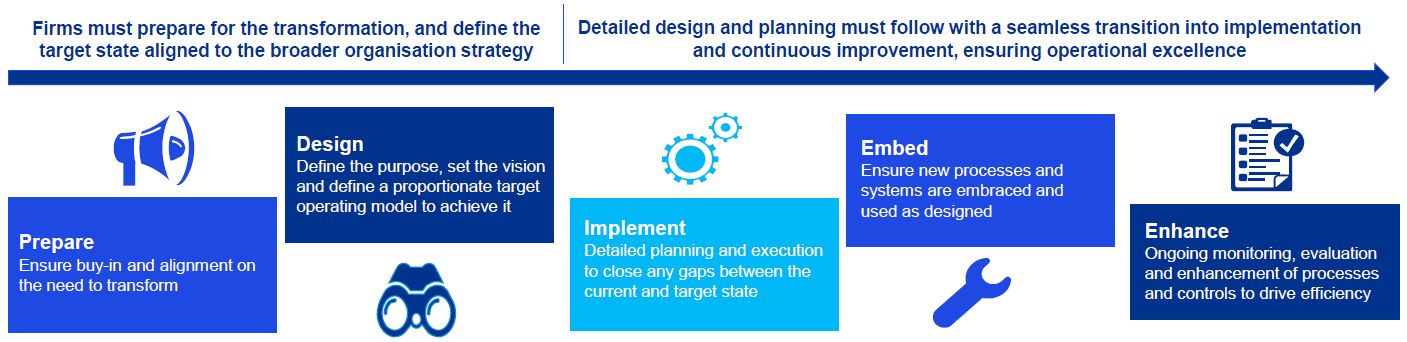

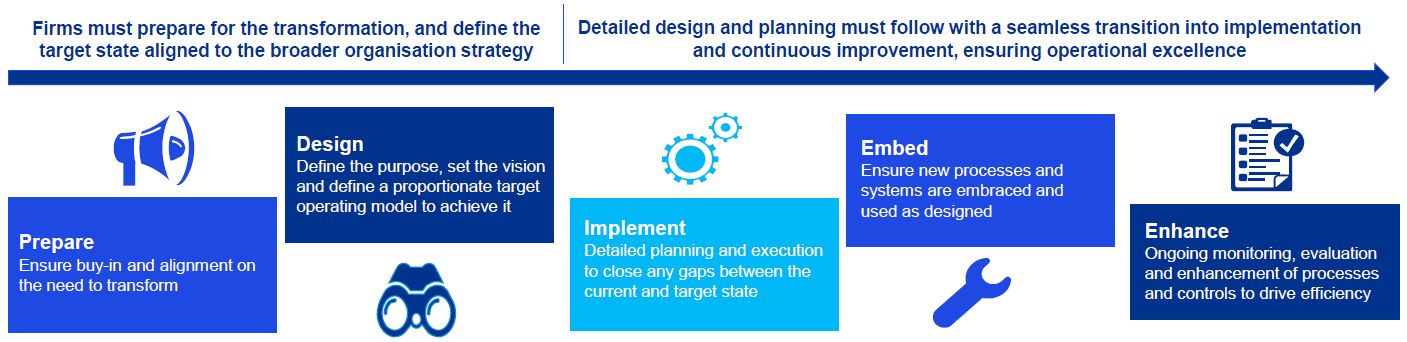

We can also assist with the design, review or monitoring of your regulatory frameworks - ensuring they are appropriate and operating effectively. Whether this is a gap analysis of your framework compared to regulatory requirements and guidance or conducting an independent review of the operational effectiveness of your controls.

KPMG can also support your business with staff secondments where your resources may be stretched, with many experienced staff deployed across multiple jurisdictions.

If you’d like to learn more, contact a member of our Advisory team.