Following a further extension of the transitional period, the new legal regulation on the entrepreneurial status of legal entities under public law (jPöR) will finally come into force on 1 January 2027.

Also due to the ongoing Sars-Cov-2 pandemic, the new legal regulation of § 2b UStG poses a great challenge for a large number of legal entities under public law (jPöR). On the one hand, already existing processes have to be re-evaluated and documented, but on the other hand, new ones have to be created. A large number of activities of the jPöR are now likely to be subject to substantial VAT for the first time. In addition to conceptual advice on tax law, this also requires a (re)assessment of each exchange of services. Due to the sometimes enormous scope and the increasing time pressure - a delayed conversion to the new legal regulation may result in back tax payments as well as possible consequences under criminal or fine law for the management bodies of the jPöR - a digitalised and standardised solution is almost imperative. This is especially true for all those jPöR that are still at the beginning of implementation or whose projects have stalled in the meantime.

Thomas Schmidt

Director, Tax

KPMG AG Wirtschaftsprüfungsgesellschaft

Employee training by means of eTrainings

In order to correctly record tax-relevant activities and related information and to be able to collect it more easily, more comprehensively and in good quality, a corresponding basic understanding of VAT is required across the board among the employees of a JPöR. This can be achieved through the use of appropriate training measures. These are also an essential component of tax compliance and contribute to the sustainable fulfilment of tax requirements by legal entities under public law.

From a certain number of employees to be trained, eTrainings offer the opportunity to keep costs and organisational effort low. Together with the award-winning provider of innovative online training courses, WTT CampusONE, KPMG has developed the

„VAT for local authorities“ training course. On our website „Virtual learning that's fun“ you will find further information, a demo video and the opportunity to request a free trial access. You can also watch the recording of our joint webcast The new VAT obligation for local authorities".

Video: More information about our training programme

I. Legal background

Until 2016, or if the option is exercised in accordance with Section 27 para. 22 sentence 3 UStG up to and including 2026, VAT is based on the definition of a business of a commercial nature. 3 UStG up to and including 2026 is based on the definition of a business of a commercial nature (BgA) from the German Corporation Tax Act: this means that legal entities under public law are or were only entrepreneurs¹ within the meaning of VAT (Section 2 (3) UStG) within the scope of their business of a commercial nature (BgA) and are therefore subject to VAT. However, with effect from 01 January 2017, the reform of the public sector taxation of sales with § 2b UStG has gained legal force2. Against the background of a design in compliance with European law of the concept of entrepreneurial VAT - the wording and systematics of § 2 para. 3 UStG were not compatible with Art. 13 VAT Syst Directive, which “regards that the tax liability or exemption from the public sector is subject to other conditions”3 - therefore, the existence of a BgA will no longer be important in the future. Instead, according to § 2b UStG, a distinction must be made in future between actions based on private or public law and the existence of a major distortion of competition as a result of the non-taxation of jPöR.

II. Status Quo: Project delays and obstacles, low final project completions

Although the legislator has provided for a transitional period of several years, it has become apparent in consulting practice that final project conclusions, i.e. in particular the stocktaking, evaluation and establishment of the correspondingly necessary processes as well as their implementation, have only been achieved in very few cases. Not least as a result of the ongoing pandemic, numerous delays occurred here.

The enormous number of individual activities and individual facts make internal and external documentation very complex. This is followed by a variety of subsequent problems. Thus, different jurisdictions in the organisational units of legal persons under public law as well as a frequently different awareness of the problem with regard to the new legal regulation are the reason for a widely heterogeneous processing quality.

Furthermore, the quality of the inventory of services now potentially subject to VAT, in the form of so-called budget screenings, as well as the corresponding feedback from individual organisational units, often still requires time-consuming follow-up work by the tax function.

The limited availability of personnel as well as tight time budgets lead to permanent delays and also recurring new pronouncements of the tax authorities require a revision and reassessment of the entrepreneurial status and consequently of the VAT liability.

Is your organisation ready?

The KPMG Health and Readiness Check provides you with an overview

The conversion to Section 2b UStG is a Herculean task for jPöR, which not only affects the tax function, but also presents the entire organisation with changes and new challenges. Our § 2b UStG team supports you with an expert and objective view at short notice in assessing the maturity level of your conversion project and in drawing up or updating an existing implementation roadmap. We examine the current implementation status of your organisation, both from a tax perspective (including the completeness and accuracy of the inventory exemption) and from a technical/organisational perspective (e.g. regarding implementation in IT and process adjustments).

Product sheet: KPMG Health and Readiness Check

Talk to our experts for support:

Enquire about KPMG support now

III. The previous legal situation pursuant to § 2 para. 3 UStG - Link to the existence of a BgA

As already noted, the VAT liability of jPöR was previously linked to the existence of a BgA. Whether such a BgA is present must be or, in the opinion of the (German) tax authorities, uniformly decided for sales and corporate tax purposes in accordance with § 2 para. 3 UStG4.

Pursuant to § 1 para. 1 no. 6 KStG, the BgA of the legal entities under public law is subject for the purposes of corporate tax. BgA are, in particular, all facilities that serve a sustainable economic activity to generate income outside of agriculture and forestry and stand out economically within the overall activity of the legal person under public law. The intention to make a profit and the ownership interest/shareholding in the general economic circulation are not required (§ 4 para. 1 sentences 1 and 2 KStG). The BgA does not include companies that primarily serve the exercise of official authority (supervisory companies, § 4 para. 5 sentence 1 KStG). Exercise of official authority is an activity that is peculiar and reserved to the public body. A characteristic feature is the fulfilment of tasks under public law that are derived from state power and serve state purposes5.

When assessing whether a particular activity of a legal entity under public law is a sovereign activity or a BgA, the character of the respective activity is always decisive, taking into account the neutrality of competition6. This also applies to the assumption of activities of a legal person under public law by another person under public law as a so-called assistance service.

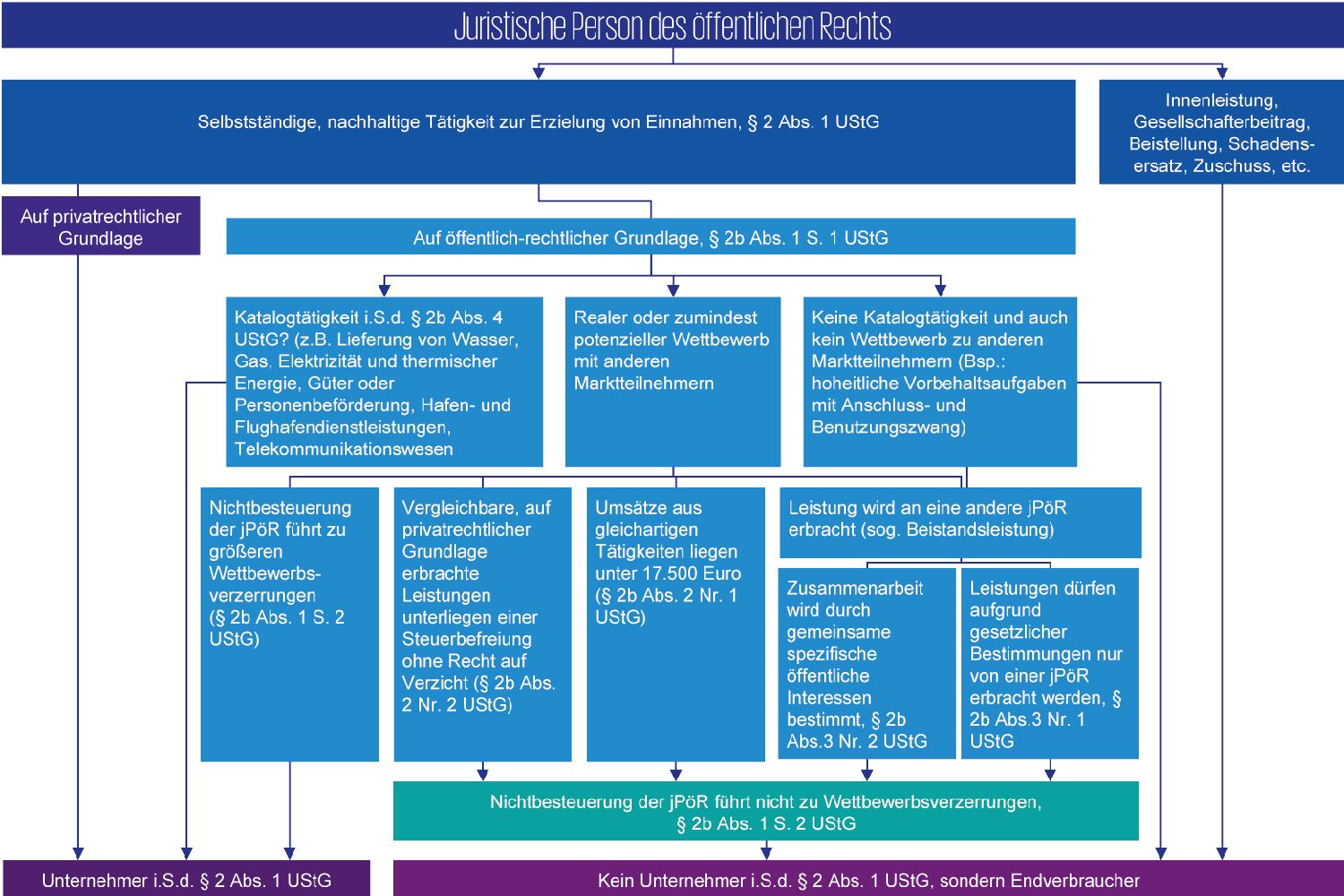

IV. § 2b UStG - the new regulation of the entrepreneurial property in overview

From a legal point of view, the new regulation § 2b UStG only standardises exceptions to the general entrepreneurial status. These must be checked separately for each individual activity carried out. Systematically, this leads to a departure from the traditional German legal understanding, which has so far linked the tax exemption to the existence of a BgA. According to § 2b Para. 1 UStG, “legal persons under public law shall not be deemed to be business entities within the meaning of § 2 insofar as they carry out activities which are incumbent upon them within the framework of public authority, even if they levy customs duties, fees, contributions or other charges in connection with these activities. Sentence 1 does not apply if treatment as a non-entrepreneur would lead to greater distortion of competition.”

A concretisation of the existence of major distortions of competition, by way of a negative delimitation, is found in paragraphs 2 and 3 of the provision. However, an activity within the framework of public authority is required for the application of § 2b UStG. On the other hand, acting on the basis of private law always results in the services rendered being considered a business and thus subject to turnover tax.

However, if a catalogue activity within the meaning of § 2b para. 4 UStG is involved, for example the supply of water, gas, electricity and thermal energy, goods or passenger transport, port and airport services or telecommunications, jPöR are always considered business entities, provided that the other requirements of § 2 para. 1 UStG are also met7.

1. § 2b Para. 1 UStG

a) Entrepreneurship of legal persons under public law

The prerequisite for the exemption of § 2b UStG is the existence of the entrepreneurial property according to the general regulations of § 2 para. 1 UStG.

Legal persons under public law are generally to be regarded as business entities if they “perform a sustainable activity on their own to generate income (economic activity). In this context, it is irrelevant what the corresponding income is. Benefits for which duties, fees, contributions or other charges are levied in return can also be economic activities within the meaning of § 2 para. 1 UStG”8.

b) Activity within the framework of public authority

Activities within the scope of public authority require a special regulation under public law as a basis9. This can result “from a law, a legal ordinance, a statute, from state treaties, constitutional treaties, administrative agreements, administrative arrangements, public law treaties as well as from legislation under church law”. However, if a jPöR provides services in “a private-law form of action and thus under the same legal conditions as private economic operators, these activities are nevertheless not covered by § 2b UStG”10. In this respect, it is not the object of the service that is important, but the form of action (private law or public law).

c) No major distortion of competition

According to § 2b para. 1 sentence 2 UStG, however, a jPöR can also be a business entity within the meaning of § 2 para. 1 UStG if it is active within the framework of public authority. This is the case if their treatment as non-entrepreneurs would otherwise lead to greater distortions of competition. § 2b

Para. 2 and Para. 3 UStG provide for cases as a negative delimitation in which there is no competition and consequently no major distortion of competition.

“Competition distortions can only take place if there is competition. This assumes that the service provided by a jPöR on a public law basis could also be provided by a private business entity. The activity of jPöR must therefore be market-relevant”11. A distortion of competition within the meaning of § 2b UStG can then arise if public and private economic participants meet in a market-relevant manner and the different “taxation distorts the competitive situation in favour of or at the expense of a market participant”12.

Such a market-relevant encounter requires the real and not only hypothetical service provision option by the private company13. Such a distortion of competition is ultimately a “major” within the meaning of the norm, if it is not merely insignificant14.

If several corporate activities are carried out, which are the responsibility of the jPöR within the framework of public authority, the existence of major distortions of competition must be checked for each individual activity. Only if such are not available, the sales are not taxable in accordance with § 2b para. 1 UStG. § 2b UStG provides for a number of constellations of facts (§ 2b para. 2 and 3 UStG), which regulate under what circumstances such a distortion of competition does not regularly exist.

2.§ 2b para. 2 no. 1 UStG

An annual turnover of not exceeding EUR 17,500 does not lead to a greater distortion of competition. According to the legislative assessment, these are always insignificant distortions of competition and thus non-business activity - in this respect, there is also no right of choice of jPöR15.

3. § 2b para. 2 no. 2 UStG

Furthermore, there is no distortion of competition within the meaning of the provision if comparable services of private business entities are also not charged Value Added Tax due to a tax exemption. Such services do not lead to entrepreneurial activity in accordance with the law. However, if the tax exemption (pursuant to § 9 para. 1 UStG) can be waived, this does not apply16.

4. 2b para. 3 no. 1 UStG

In contrast, if the cooperation of jPöR alternatively relates to services that may only be provided by jPöR on the basis of applicable statutory provisions and thus exclude private economic participants from the provision, there are no major distortions of competition in accordance with § 2b para. 3 no. 1 UStG17.

5. § 2b para. 3 no. 2 UStG

If, on the other hand, a cooperation is determined by common specific public interests (so-called assistance services), major distortions of competition are also not present despite real or potential competition. Whether there are common specific public interests within the meaning of the provision is determined in accordance with § 2b para. 3 no. 2 letter a - d UStG.

- § 2b para. 3 no. 2 letter a UStG: The services are based on long-term public law agreements. The determination of this factual characteristic is ex ante. A long-term period of at least five years is to be assumed on a regular basis.

- § 2b para. 3 no. 2 letter b UStG: The services must also be used to maintain public infrastructure. This includes all facilities of a material and institutional nature that are necessary for the exercise of official authority within the meaning of § 2b Para. 1 UStG, i.e. in particular the administrative, service or technical infrastructure.

- § 2b para. 3 no. 2 letter c UStG: The services may only be provided against reimbursement of costs, i.e. covering costs.

- § 2b para. 3 no. 2 letter d UStG: The performers essentially provide similar services to other jPöR.

6. Separate check for possible competitive distortions

If the conditions of a standard example, in particular of § 2b para. 3 no. 2 UStG, are met, a separate examination for the existence of possible harmful distortions of competition is required in the final analysis against the background of European law, in the opinion of the (German) tax authorities18.

7. Audit schedule of § 2b UStG

Chart (in German only)

Source: Trost/Menebröcker, Value Added Tax in the public administration - guidance for cities and municipalities, 2nd Edition. 2019.

V. Digitalisation and automation as a solution

The changeover to the outlined principles of § 2b UStG can be made manageable through the use of digital solutions. In particular, collaborative tools or platforms can help to carry out a budget screening, i.e. an inventory of possible services subject to VAT, more quickly in a standardised form. Information can be collected in a targeted, structured and uniform manner. They are provided digitally for internal documentation and as external evidence to the (German) tax authorities. In this way, the control function can obtain an ongoing overview of the current processing status and selectively support individual organisational units in data collection. The support of external counselling is simplified by the digitalisation and standardisation of household screenings and can help to save costs.

In addition, the standardised approach in household screening enables the machine evaluation of the structured data and information obtained. If each activity no longer has to be considered manually and individually, the process can be accelerated, which can be essential against the background of the approaching mandatory applicability with the expiry of the option period. In addition, the results can be reviewed at any time for a change in administrative opinion or case law.

Data analysis makes it quicker and easier to identify cases with greater risk potential and to subject them to a qualified individual case review. The possibility of evaluating a quantitatively and qualitatively sufficient sample instead of a time-consuming manual full audit of all results can contribute to an increase in efficiency - especially because the (German) tax authorities are increasingly moving towards establishing corresponding test and estimation procedures within the scope of the digital tax audit.

Overall, digitalisation and automation with regard to § 2b UStG offer the opportunity for efficiency gains and relief of one's own resources. However, the users, the application environment and regulatory requirements must be taken into account. Technological solutions should be easy to apply, data security and data availability should be guaranteed and the effort of an implementation in the IT system should be considered.

In practical implementation, it will also regularly be essential that such a solution can be used technically without prior knowledge and that it uses standard office applications or digital collaboration platforms. Additional software with lengthy approval and installation processes would take away much of the practical application potential of the presented possibilities of a digitalised and automated solution at jPöR.

VI. Application example: The KPMG§2b Assistant

An example of an implementation of such a solution approach, in accordance with the principles outlined, is the KPMG §2b-UStG Assistant. This is a solution that supports jPöR in implementing the new legal provision of § 2b UStG in digital and automated form.

The household screening is carried out via a browser-based online application based on Microsoft SharePoint, combined with an IT infrastructure developed by KPMG (“KPMG-Central.de”): The individual activities of the jPöR as well as all legal facts required for § 2b UStG can be recorded by means of a digital and standardised questionnaire/survey form. In addition, the contracts on which the activity is based or further research results can be filed as documentation directly for the individual activity.

The solution is intuitive and easy to use, does not require the installation of any software beyond standard applications and is designed for collaborative work between the individual organisational units and KPMG experts. In addition, the German data protection claims are fulfilled.

Due to the standardised data collection, an automatic evaluation is subsequently possible, i.e. the subsumption of the facts is carried out by KPMG on the basis of a digitally modelled decision tree under the legal regulations of § 2 para. 1 in conjunction with § 2b UStG. The evaluation of results as “entrepreneurial activity” or “non-entrepreneurial activity” is simplified and accelerated by this machine evaluation option.

The random analysis of the basic information as well as the evaluation results can be made easier and targeted by filtering, selection, sampling or random selection, since there is a digital data base.

SOS §2b UStG - a breath of fresh air for your conversion project

Has your conversion project stalled? Then you should get to know our SOS §2b UStG offer.

As part of project management, our experts ensure that your project gets going again. They support the processing of possible gaps and their causes in the previous project plan and together with you define an optimized plan with suitable measures and the necessary resources. Structured project management ensures transparency and acts as a control or escalation instance. Due to the tax law background of the KPMG experts, the project team not only supports you in project management, but also actively in overcoming the legal and procedural hurdles. If desired, the KPMG-§2b-UStG assistant can also be used.

Feel free to contact us.

VII. Conclusion

A digitalised approach offers jPöR a simpler and more efficient structuring of data and information. This can promote a standardisation of data collection across all organisational units and simplify cooperation with external consultants, which in addition to increased compliance also brings potential cost savings. A simplified review and supplementation of new or changed legal opinions of the (German) tax authorities and case law, the possibility of differentiation according to risk potential and a regularly simpler applicability and feasibility not only help with internal documentation and simplify evidence vis-à-vis the (German) tax authorities, but can also help to implement the requirements of § 2b UStG in a timely manner and to deal with the complexity of the regulation, which, against the background of alternatively threatening consequences under criminal and regulatory law, should regularly suggest a digitalised solution approach.

1 § 2 para. 3 sentence 1 UStG; Sec. 2.11 para. 4 p. 1 UStAE; OFD Lower Saxony, decree/order of 27 July 2012, p. 7106-283-St 171, DStR 2012, p. 1923.

2 Tax Amendment Act 2015 dated 02/11/2015, BGBl. 2015 AS PER 1834.

3 Scientific Service of the German Parliament, Union law conformity of the draft of a new § 2b VAT Act (§ 2b UStG-E), development PE 6 - 3000 - 215/14. Available at: https://www.bundestag.de/resource/blob/405422/8d3ed0556c9f95167f18126f48910af4/PE-6-215-14-pdf-data.pdf. Last accessed 10/11/2021.

4 Sec. 2.11 para. 4 p. 3 UStAE.

5 H 4.4 “Territory Operation”, first bullet point, KStR 2015; Hessian Ministry of Finance, Decree/Order of 20/07/2011, SEE 7106 A - 096 II 51, SEE 5.

6 Hessian Ministry of Finance, Decree, Order of 20/07/2011, p. 7106 A - 096 II 51, p. 6 et seq.; Decree/Order of OFD-Rostock dated 21 November 2002, p. 2706 - 04/01 - St. 242; decision of the department heads of the highest tax authorities of the countries, Bundestagdrucksache 15/4081 dated 02/11/2004, p. 9; Baldauf, DStZ 2011, p. 40.

7 BMF Guidance dated 16/12/2016 - III C 2 - S 7107/16/10001, DOK 2016/1126266, DStR 2017, 40; Rz. (Randziffer [margin number]) 55.

8 Ibid. Fn. 7, Rz. 4-5.

9 Ibid. Fn. 7, Rz. 6.

10 Ibid. Fn. 7, Rz. 6.

11 Ibid. Fn. 7, Rz 23

12 Ibid. Fn. 7, Rz. 30.

13 Ibid. Fn. 7, Rz. 29.

14 Ibid. Fn. 7, Rz. 31, cf. also ECJ dated 16/09/2008 - C-288/07, Isle of Wight, DStRE 2008, 1455.

15 Ibid. Fn. 7, Rz 33.

16 Ibid. Fn. 7, Rz. 38.

17 Ibid. Fn. 7, Rz. 41.

18 BMF Guidance dated 14/11/2019, III C 2 - S 7107/19/10005 :011, BStBl I 2019, 1140.

Co-author: Christian Bischoff, Senior Associate, Attorney, KPMG AG Wirtschaftsprüfungsgesellschaft