Recent hikes in electricity and gas prices on the European energy markets are currently perplexing buyers and risk managers across all energy-intensive industries. Lucky are those who have planned for the long term and fixed purchase prices especially for electricity and gas over the past few years, as part of a structured energy procurement system.

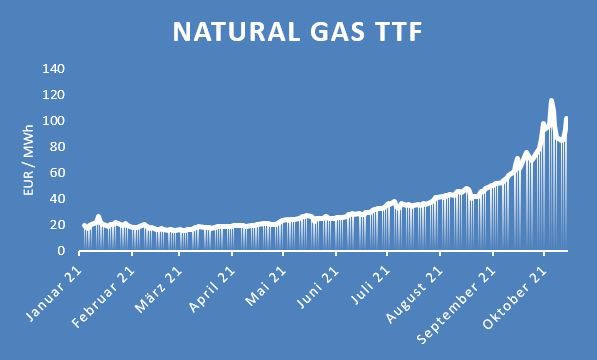

On the one hand, the industry's long-term prospects against the backdrop of changing regulatory framework conditions and the pricing of EU-wide CO2 emissions are driving this development; on the other hand, the demand for LNG in Asia is also playing a major role. Apart from the uncertainties about the development of the global economy and the ensuing demand-side instability, the sharp rise in CO2 emission prices in particular, together with coal and gas prices, have been plunging the electricity markets into an ever-increasing price boom since the beginning of the year. Gas prices in the market areas Net Connect Germany and Gaspool, now Trading Hub Europe (THE), which are particularly important for energy-intensive industry, showed a similar development. Price trends in the Title Transfer Facility (TTF) gas contract show the European dimension of the increased price levels in energy carriers.

Fig. 1: Trend in prices of Natural Gas TTF futures (market data from Thomson Reuters)

In the energy-intensive industrial sector, the increased energy prices, on top of skyrocketing CO2 prices and the anticipated further shortage of certificates in the future owing to the European climate targets, are an additional existentially threatening trend for established pricing mechanisms and entire business models.

Hedging energy price risk

Given the current market environment, the imperative to devise innovative hedging mechanisms embedded in the pricing mechanisms of the sales products and to deploy all available means in risk management is seen as a vital strategy for preserving profitability and viability in the energy-intensive industry. It has become virtually impossible to forgo employing derivative financial instruments to manage risks and secure margins, both in gas and electricity procurement and in the management of CO2 emission certificates, unless the risk can be avoided through appropriate procedural measures in the pricing mechanisms of the company's own products on the sales side.

Obviously, the first step is to analyze the energy and gas requirements and the resulting market risks for the company. For instance, having to procure a certain amount of energy does not necessarily entail a direct risk. Any lack of hedging of large, easily predictable quantities, i.e. for example, no price fixing of the amount of energy to be procured, would in this case give rise to the risk in the first place. Often, hedging the procurement price for the energy required for production is inevitable if a company cannot directly pass on any price fluctuations to their customers by raising product prices. From a risk management perspective, such hedges should already be in place by the time the procurement contract is concluded to prevent the build-up of an uncovered risk position and the corresponding increase in exposure. Additionally, if a need over a long-term time horizon is known, strategic hedging (small "slices") or structured procurement can be used to benefit from falling market prices at a later date.

This means that an integrated end-to-end view along the entire value chain, if necessary also across several Group entities, is required to correctly capture the exposure. This also encompasses a thorough analysis of the direct and indirect dependency of procurement prices and/or expense and income items on fluctuations in energy prices. This kind of detailed analysis, in addition to identifying the full "mechanics" of the impact of energy price fluctuations on company key figures, also allows identifying the data base indispensable for ongoing demand management as well as uncovering any unavailability of data and poor data quality.

We also believe that risk management will be particularly important for the future of the industry and will be given increased attention in both the procurement and controlling departments. The growing need to hedge against potential market price fluctuations by energy-intensive industries is reflected in the trading volumes on the European Energy Exchange (EEX). In 2020, it reached a new record high; for the first time, it exceeded the threshold of 4,000 TWh, which translates to an increase of roughly 19%. Over the same period, Germany recorded an increase of 16%. Hedging by means of exchange-traded hedging instruments also has the advantage of avoiding the need to negotiate prices bilaterally in the future and giving both procuring and selling companies greater planning certainty.

Don’t let the strategic measures discussed above slip through your fingers, take decisive action instead!

Please do not hesitate to contact us.

Source: KPMG Corporate Treasury News, Edition 116, November 2021

Authors: Ralph Schilling, CFA, Partner, Head of Finance and Treasury Mangement, KPMG AG; Bardia Nadjmabadi, Senior Manager, Finance and Treasury Mangement, KPMG AG; Moritz zu Putlitz, Manager, Finance and Treasury Mangement, KPMG AG

Ralph Schilling

Partner, Financial Services, Head of Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft