Supply chain problems, rising freight rates and inflation

At present, the price development of commodities only seems to know one direction: upwards. The reasons for the current situation are complex and stem from a variety of factors:

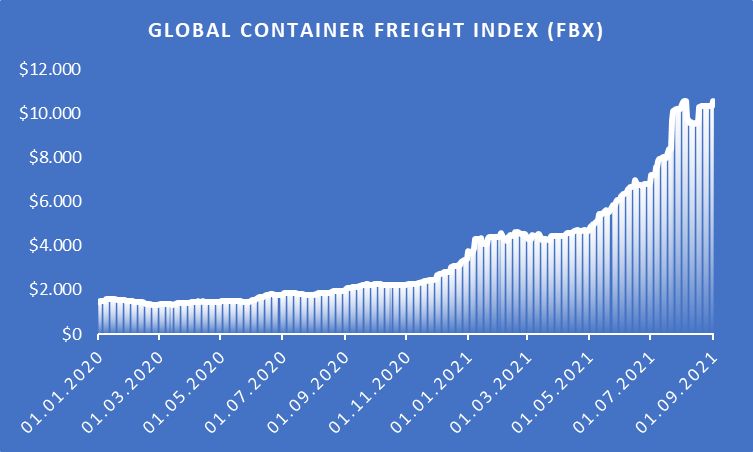

Since the beginning of the pandemic, consumption in the USA and Europe has unexpectedly gone up. In particular, goods from China are in high demand. However, the number of containers in which the goods start their journey to the West is limited. This shortage and bottlenecks in the return of containers (for example, due to Covid-related work stops in Chinese ports) sometimes lead to a significant increase in global freight rates. One of the many indicators for this is the so-called World Container Index (WCI) of the industry analyst Drewry. Since the onset of the pandemic, it jumped from 2,000 to a value of 10,0001 - meaning that freight rates have grown more than fourfold since the fall of 2020. The Baltic Dry Index paints a similar picture: it almost tripled since the beginning of the year.

Fig. 1: Development of container freights as monitored by the Freightos Baltic Index (FBX). Global Container Freight Index (Market data from Thomson Reuters)

This increase in transportation costs has a direct impact on the cost of primary and secondary commodities. This is compounded by quality deficits and extended waiting times for goods due to slowed supply chains. For retailers, the effects are already showing in their financial situation, resulting in an increase in sales coupled with a decline in margins. The VCI2 surveyed its members on the effects: in May, nearly half of the companies surveyed responded that their operations were "severely" or "very severely" affected by the bottlenecks. As a result, retailers are responding to the increased procurement costs, often by passing them on to end consumers. The result? A potentially sizeable contribution to inflation.

The Kiel Institute for the World Economy (IfW) believes that inflation could rise to a level of up to 4%. Also, according to the BGA3, higher levels of producer prices can be expected in Europe in the long run. Analysts and economists disagree on whether the current development is a direct consequence of the pandemic or a long-term trend.

The passing-through of market price change risk

A current trend is that the commodity-intensive industry is passing on the high procurement prices to customers in an effort to keep trading margins as stable as possible. However, market price risk cannot be passed on in all industries. One recent example of this is the wind energy sector. Manufacturers of wind farms are often exposed to market price risk without appropriate price protection through fixed price contracts or derivatives, most notably in the bid and procurement phases. During the bid phase, prices for the sale of the wind farms are fixed on the sales side. However, on the procurement side, there is usually little or no price fixing for the required commodities until the start of production or construction. As a result, the wind farm manufacturer is fully exposed to the risk of an intermittent rise in steel prices amid high price volatility. Unlike copper, for example, the market price risk for steel cannot be hedged on a one-to-one basis or only with the help of proxy hedges using forward contracts. In addition, there is no optimal negotiating position on the sales side due to high level of competition. This makes it difficult to implement risk-mitigating measures, such as indexing steel prices, which can cushion the procurement-side risk. Such an example can be applied to other sectors within the commodity-intensive industry.

Mitigate procurement and sales-side risk

In many cases, companies in the commodity-intensive industry and commodity trading are faced with the challenge that they are usually not in a position to properly determine their exposure from open positions on the procurement and sales side. The reason for this is usually a heterogeneous data and system landscape, which makes it difficult to measure and collect exposure in a uniform and centralized manner. While this may not pose a major risk in a laterally trending market, ation may be different in times of highly volatile commodity prices. The current market situathe sitution has once again given companies reason to question the appropriateness of previous risk management strategies, methods and processes and the design of the risk cycle in trading and treasury with regard to the ability to sustainably manage uncertainties.

Companies have several alternative courses of action for dealing with volatile commodity prices in the long term:

- Risk strategy and risk KPIs

Be sure to check whether your current risk strategy matches your corporate targets and whether the significance of relevant risks (market, credit and liquidity risks) are known to your company. Verify that the current indicators of risk allow a reliable statement on the impact on the company-specific performance indicators (EBIT, cash, equity ratio) according to which the company is managed. It is best to define a clear risk management strategy. - Exposure survey

Do you know the level and time of occurrence of your commodities risk? Get an overview of which transaction types should be included in your exposure and/or your hedges (physical stocks, physical delivery contracts, financial contracts, time buckets, delivery places, etc.). In doing so, it is also a good idea to consider to what extent and with what delay the risks can be passed on, for instance, because a risk is overestimated if only a commodity’s purchasing price is looked at without considering how sales prices react to changes in the commodity markets. - Risk capacity

Define which risk you are ready to bear in this strategic area. Be sure to choose an appropriate methodology to measure and report risk. Decide on which risks you may enter into with the help of a risk/reward profile. In doing so, you may want to differentiate between a threshold for times of normal business activity and a different threshold in case of an extreme scenario. - Hedging strategy

Hedging strategies should be formulated in consideration of your goals when purchasing commodities. Is there a possibility to trade for own account or to enter into positions using a market-timing strategy? Define the methodology used to measure the success of your hedging strategy (e.g. benchmarking) and perform it regularly. Make sure the hedge’s effectiveness remains intact from both an economic and an accounting point of view, in consideration of the current market situation (e.g. effectiveness of proxy hedges). - Framework conditions for commodity trading

It is important to create a clear governance structure, which enables the definition of framework conditions for commodity trading and clearly governs responsibilities. For this, identify who is entitled to change the existing framework conditions and whether it is possible to override the adherence to these rules. Define which products/instruments are permitted for trading.

The past few months have once again shown that it may well be useful to demonstrate to management and cost controlling the need for and benefits of an effective and comprehensive risk management for market price risk. Lifeboats do not get built in the middle of a storm. Be prepared in good time for the next extreme events and develop safeguards to protect yourself against any future turbulence.

KPMG's Finance and Treasury Management team will be happy to discuss your needs.

Source: KPMG Corporate Treasury News, Edition 114, September 2021

Authors: Ralph Schilling, Partner, Finanz- und Treasury-Management, KPMG AG; Moritz zu Putlitz, Assistant Manager, Finanz- und Treasury Management, KPMG AG

______________________________________________________________________________________________

1 USD/40ft Container

2 Association of the German Chemical Industry e.V.

3 Bundesverband Grosshandel, Aussenhandel, Dienstleistungen e.V. (German Association of Wholesale, Foreign Trade, Services e. V.; BGA)

Ralph Schilling

Partner, Financial Services, Head of Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft