Your wealth is subject to numerous risks that can be of a complex nature and are not always obvious. Such risks are particularly important when you live and do business in multiple jurisdictions. If they do materialize, such risks can trigger severe financial consequences and disruption for you, your family members and your businesses.

KPMG’s Private Client team in Switzerland consists of around 40 tax advisors, lawyers and financial experts who can help you identify, mitigate and monitor these risks. To do this holistically and with your specific situation in mind, we call on KPMG’s private client advisors in 154 jurisdictions and coordinate seamlessly with a large pool of selected local and international partners.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

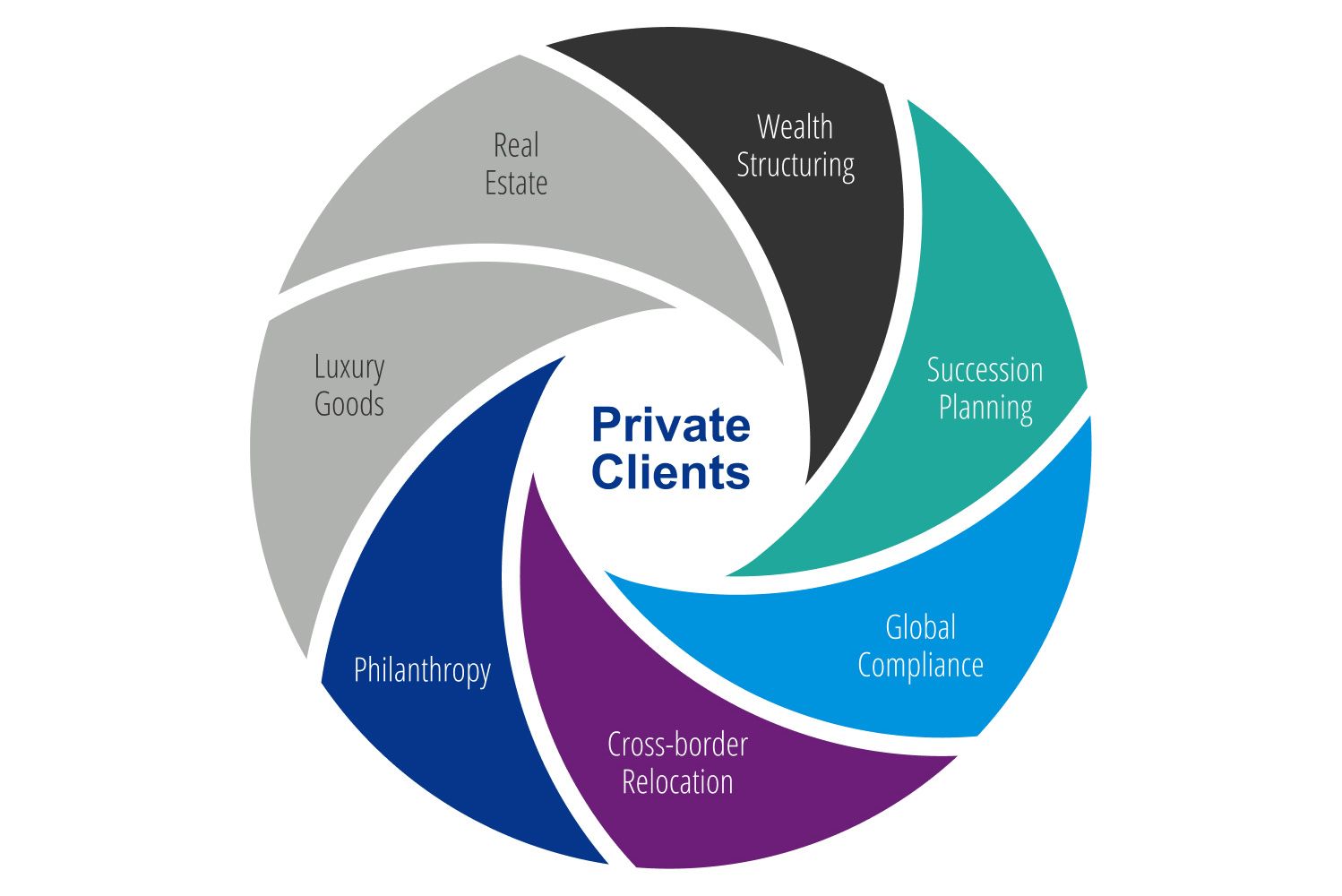

Our expertise

As a private client, you will benefit from KPMG’s multidisciplinary expertise across tax, legal, cyber and advisory. Our knowledge from the corporate world is made available to you.

With us as your trusted advisor, you will receive deep insights into the latest regulatory trends and best practices, fast access to a Big Four global network and support from leading specialists whenever and wherever you need them.

Our solutions are tried and tested and designed to meet not only the needs of private clients but also their businesses. That’s why we count high-net-worth individuals, entrepreneurs and top executives among the private clients we serve. Protect your wealth today and for future generations.

Your key contacts

We gladly remain at your disposal to answer any questions you may have.

Discover more

Family Office & Private Clients

KPMG's team of tax professionals can help you with all aspects of personal and family taxation.

Family Offices & Private Clients Newsletter

Tax and legal developments affecting individuals, entrepreneurs and family offices.

KPMG Law

In today’s rapidly evolving legal environment, we offer more than just sound legal advice.

Philanthropy: A New Wave?

Discover the new trends that are facing philanthropists of the future.