Corporate Tax

Corporate Tax

Corporate taxes form a key part of financial corporate governance. A sound business strategy needs to include tax planning.

A sound business strategy needs to include tax planning.

When devising tax plans and strategies for Swiss and international companies, an in-depth knowledge of how each business operates is an essential starting point. Working closely with the management team, the advisors from KPMG analyze the company’s overall tax situation and lay the foundations for long-term tax management. A multidisciplinary approach and an ongoing knowledge transfer ensure that your business can operate in compliance with tax law in any scenario, respond flexibly to any changes and take advantage of any tax privileges. Targeted support on the questions that arise every day is a key prerequisite for optimizing a company’s tax situation.

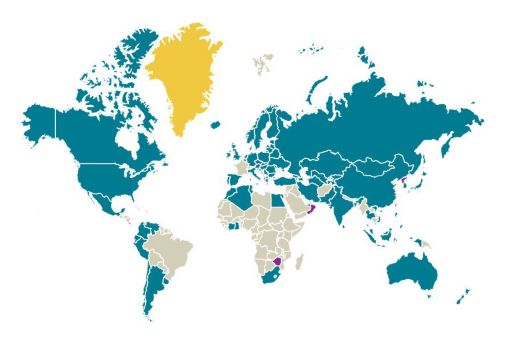

KPMG’s tax advisors are familiar with Swiss and international tax law and always keep abreast of the latest research. With 13,000 tax advisors based in 106 countries, KPMG is one of the few partners that can share its expert knowledge anywhere in the world. Advisors work in teams assembled to suit clients’ needs. They have a clear understanding of tax legislation and many different areas of a business. KPMG keeps clients and industry professionals up to date with the latest tax news and technical developments from its international centers of expertise and its Swiss tax offices.

KPMG’s expertise

- Preparing tax returns and tax balance sheets for Swiss and international companies with any legal form

- Devising tax optimization measures, e.g. in the event of restructuring or transactions

- Assistance with company audits

- Representation in dealings with the tax authorities

- Preparing financial accounts, annual financial statements and financial reports in accordance with Swiss and international accounting and reporting standards

- Support on specific tax issues such as salary and expenses payments or succession arrangements

- Value Chain Analysis (VCA) methodology detecting and defining value creation activities, people and locations including DEMPE – Analysis for IP planning

Further information

TRAF Impulse sheet (PDF)

Save heaven interest rates 2024 (PDF)

Real Estate Tax & Legal (PDF)

Tax Law of the Canton of Zug (PDF)

Higher return and pension (PDF, in German)

Swiss Tax Reform (TRAF) – Transitional Measures (PDF)

Investment Protection (PDF)

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia