Companies experience varying degrees of crisis, but without active crisis management, the consequences can be far-reaching because a lot is usually at stake in special situations.

The lack of a professionally managed restructuring or turnaround process can lead to the insolvency of the company with financial damage for the stakeholders involved. Additionally, it creates reputational risks for shareholders, the board of directors and the management.

The various crisis situations have one thing in common: There is little time to analyze the situation, to prepare the restructuring program and to implement restructuring measures.

It is essential to have all the necessary information available for analyzing the causes of the crisis. The crisis causes then need to be addressed suitably within the restructuring program. In the end, a professionally organized turnaround management ensures that the identified restructuring measures can be implemented efficiently and that the crisis can be overcome.

For the purpose of crisis management, internal and external communication must switch to crisis communication mode. This will ensure that the goal of restructuring the company is presented in a way that is appropriate for the target audience and that the stakeholders trust and confidence is restored.

In order to deal professionally and efficiently with the diverse problems of a corporate crisis, KPMG's Turnaround & Restructuring team specializes in analyzing each company's individual starting position, identifying areas and options for action, as well as developing, guiding and implementing the required measures for the operational and financial realignment.

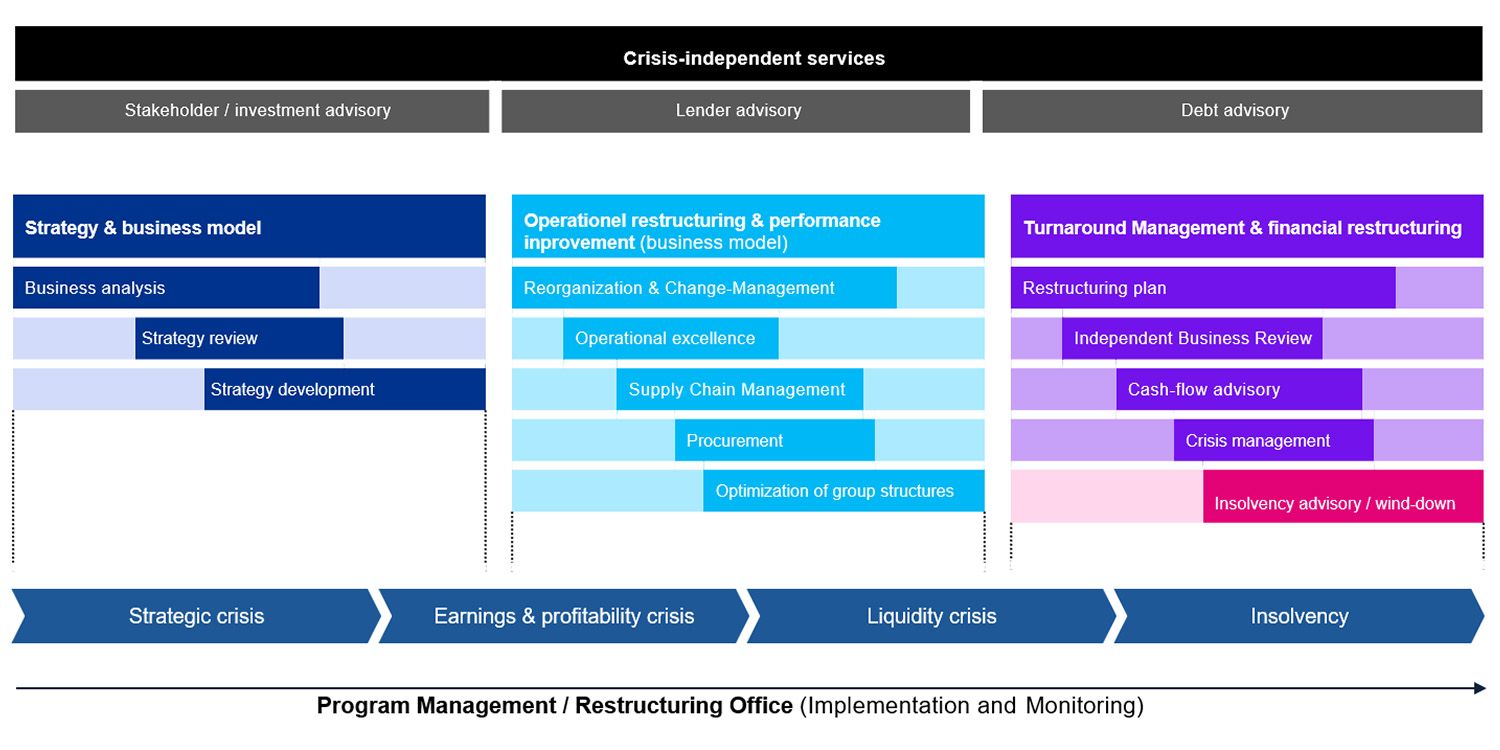

The four phases of corporate crises

Corporate crises can typically be divided into four phases. Varying restructuring measures are required for a successful turnaround, depending on the phase and the severity of the crisis situation.

Companies must be able to identify in which phase of a corporate crisis they are in. The different phases can be classified as follows:

Strategic crisis

- A strategic crisis is not immediately apparent. For instance, any change in the market or customer structure may lead to the fact that the current state of the organization promises less success in the future.

- It will therefore be imperative to adapt the current business model and the resulting product offering to the new market conditions (product-market fit) to ensure that the company will continue to have unique selling propositions and success factors in the future.

- This takes place as part of a strategic restructuring or reorganization. If strategic restructuring measures are not carried out, this can lead to the next phase of a corporate crisis.

Earnings & profitability crisis

- If changed market conditions are not addressed by strategic turnaround measures, they can lead a company into an earnings crisis: Sales and margins decline and, in the medium term, losses will erode the company's substance and equity.

- Against this background, operational restructuring and performance improvement measures are needed to overcome the earnings crisis. The aim is to reduce costs and increase sales again (value creation). While planning and implementing such processes and measures are necessary to prevent an even deeper crisis, they also absorb management capacities and thus important resources of the company.

Liquidity crisis

- Liquidity crises are characterized by reduced cash flow and thus low liquidity, so that short-term liabilities can no longer be paid in full or on time. The amount of overdue payables increases and insolvency is imminent. By this point at the latest, all executives and the board of directors should have realized that there is an emergency, that short-term, liquidity-securing measures must be implemented and all strategic options (in- and out-of-court) need to be evaluated. In this regard, the availability of a rolling short-term cash flow forecasting tool is essential in order to monitor the solvency of the company, which is the responsibility of the board of directors according to Swiss law (Art. 725 CO).

- The existing stakeholders of the company such as banks, suppliers, customers or landlords usually add to the pressure and contribute to the accentuation of the crisis and the impending insolvency.

Insolvency / Bankruptcy

- Once the crisis has reached such an acute stage due to insufficient implementation of corrective measures that the continuation of the company is no longer possible on its own (business continuity), a court-appointed restructuring procedure can follow as a consequence in order to prevent the threat of insolvency.

- In the course of composition proceedings, the company's crisis team is supplemented by a court-appointed composition administrator. Working together with the management, the administrator decides on the further implementation of restructuring measures and monitors the actions of the top management. The goal of the composition moratorium is the restructuring of the company or the conclusion of a composition agreement. If this fails, the company is typically liquidated through insolvency proceedings.

Matters arising before and during a turnaround or restructuring process

Detecting crisis situations in their early stages requires that management reassesses the company's strategy and market position at regular intervals.

Leading indicators can be used to help interpret the symptoms of an impending crisis.

But even if management has already recognized the crisis situation, there are still many questions to be analyzed and answered during the crisis management process, from the turnaround analysis to the preparation of the turnaround concept and the implementation of the restructuring measures defined in the turnaround concept.

Key questions to be addressed during the turnaround analysis

- Which are the company's main business areas and how stable is their strategic positioning within the relevant markets?

- In which direction will the markets served by the company develop in the future?

- Does the company have stable unique selling propositions that will secure its long-term survival in the future?

- What are the main causes of the crisis?

- Does management have the necessary know-how and willingness to address the crisis with professional crisis management?

- Does the organization have the required staff available to handle the wide range of tasks?

- Has the company got the necessary controlling instruments in place and a complete information base to identify the key value drivers for profit & loss?

The results & conclusions of the turnaround analysis are explained within the turnaround concept in order to present the following topics in a way that is appropriate for the target group and to create a basis for discussion and decision-making for all stakeholders involved:

Focal topics in the turnaround concept

- Does the company have the ability to continue as a going concern and the ability to be restructured on the basis of it’s past and future financial development?

- What are the financing requirements for a successful turnaround or crisis management?

- What are the prerequisites and conditions for successfully implementing the turnaround?

- Are restructuring measures defined by management to address the causes of the crisis appropriate in order to implement the restructuring and reorganization and to reach the goal of a successful turnaround?

- Does the company have the necessary trust and support of shareholders, customers, suppliers, lenders and other stakeholders to implement the restructuring and reorganization?

- Are there alternative courses of action available in the given crisis situation to prevent insolvency and to achieve the turnaround?

Focal points when implementing the turnaround concept

- How is the schedule and responsibility planning for the implementation of restructuring measures defined and implemented (program management office for implementing and monitoring the restructuring measures)?

- How are measures to reduce the outflow of liquidity implemented?

- How are measures to increase liquidity inflow implemented?

- How can measures be implemented to optimize earnings?

- How can the capital structure of the company be improved?

Crisis management support

To the extent that the above questions cannot be fully answered, it may be helpful to seek external advice. This is especially important if mutual trust between the company's management and key stakeholders is strained or disturbed.

At KPMG Turnaround & Restructuring, we assist our clients in all phases of a corporate crisis, from the turnaround analysis to the design of the turnaround concept and the implementation of restructuring measures.

In doing so, we provide an independent outside perspective as well as our project management and coordination expertise stemming from countless restructuring mandates in a wide range of industries and situations.

It is our mission to be your partner and support your crisis management team.

That's why we offer you a multidisciplinary team with the right combination of experienced consultants from the following fields:

- Turnaround Management & Financial Restructuring

- Strategy Consulting

- Change Management and Program Management Services

- Corporate Finance

- Debt Advisory

- Mergers and Acquisitions (M&A)

- Law

- Tax

- Data Analytics

Problem-solving approach for restructuring situations

Our approach is always tailored to your unique circumstances and requirements.

We help your crisis managers to achieve a successful realignment and transformation:

- Strategic review: Revising and realigning the business strategy and the existing organizational structure

- Preparing independent business reviews («IBR») and IDW S6 expert restructuring opinions

- Operational turnaround and restructuring: Improving performance, profitability and operational efficiency as part of a coherent restructuring program

- Financial turnaround and restructuring: Analyzing the strategic options in special situations. Acting as lead advisor in the context of financial restructurings (in- and out-of-court)

- Liquidity planning: Preparing rolling short-term liquidity forecasts (13 weeks) and defining and implementing short- and medium-term measures to safeguard liquidity

- Business planning: Preparing integrated business / turnaround plans with a projected income statement, balance sheet and cash flow statement, reflecting restructuring measures and profitability increasing measures

- Debt advisory, including assistance in negotiations with lenders and the evaluation, structuring and implementation of alternative financing solutions

- Advising on buy-side and sell-side M&A transactions in special situations and pre-pack insolvency transactions

- Preparing and accompanying judicial composition proceedings and insolvency or bankruptcy proceedings

- Communicating and dealing with all stakeholders involved, taking into account their legitimate interests

KPMG's Turnaround & Restructuring expertise includes

- Reviewing key industry trends and market developments

- Assessing business portfolios (products, clients, markets, etc.)

- Developing restructuring advice including key scenarios and a restructuring plan as well as future trajectories

- Strategic debt advisory (acquisition financing, succession financing, MBO & MBO financing, LBO financing)

- Operating debt advisory (growth and investment financing, working capital financing, real estate financing, capital structure optimization)

- Debt advisory in turnaround- & restructuring situations

- Developing, implementing and reviewing operational restructuring and re-organization plans

- Establishing revenue growth opportunities (clients, products optimization, pricing, etc.)

- Assessing and implementing cost reduction measures (SG&A, overhead, etc.)

- Delivering net working capital reduction

- Analyzing the strategic options in special situations

- Preparing and reviewing short-term rolling liquidity planning tools (13 weeks) as well as defining and implementing measures to increase liquidity

- Developing and reviewing integrated turnaround / business plans, including the analysis of funding requirements, capital structure, debt capacity and key financial ratios

- Acting as lead advisor in the context of financial restructurings («out-ofcourt» and «in-court»)

- Debt advisory, including assistance in negotiations with lenders and the evaluation, structuring and implementation of alternative financing solutions

- Advising on buy-side and sell-side restructuring M&A transactions in special situations and pre-pack transactions

- Conducting stakeholder-specific business analyses

- Preparing expert opinions

- Supporting the development and implementation of recovery strategies

- Preparing independent business reviews (IBRs) and IDW S6 expert restructuring opinions

- Monitoring the restructuring progress and covenants as well as periodic reportings

- Working out a controlled liquidation (wind-down)

- Supporting restructuring and insolvency administrators and bankruptcy offices

Credentials

Tally Weijl

KPMG Deal Advisory

acted as sole financial advisor in the financial restructuring of the company, assisting management in negotiations with its group of lenders. KPMG also assisted the company in the development of financial models for liquidity and business planning.

2023

Feintool

KPMG Deal Advisory

acted as financial advisor and provided tax and pensions due diligence services to Feintool International Holding AG on its acquisition of component specialist Kienle+Spiess.

2021-2022

Let's Go Fitness

KPMG Deal Advisory

acted as sole financial advisor to Let's Go Fitness Group and assisted the company on reporting to its lenders in relation to the refinancing of its credit facilities. KPMG also assisted the company in the development of financial models for liquidity and business planning.

2020-2021

CCC Group and Karl Vögele AG

KPMG Deal Advisory

performed a strategic options review for the company's operations in Switzerland, including the development of a business plan model. Moreover, KPMG Deal Advisory Switzerland and Poland jointly acted as exclusive M&A lead advisor to CCC Group on the sale of Karl Vögele AG to cm.shoes GmbH.

2020-2021