Both public and private sector organizations are constantly at risk for financial and reputational loss. Past financial scandals have brought to light how financial incentives or greater pressure can lead to fraudulent reporting. The challenges faced in the current climate only increases the fraud risk, making it even more critical for organizations to be more vigilant than ever before. Financial losses due to white-collar crime have increased over the last few years.

We help our clients take the right measures to identify, mitigate and react to potentially contentious or harmful situations. We find it equally important to assist our clients in taking a strategic approach and to advise our clients on claims, recoveries and other actions that can be taken based on what we have found.

Regardless of whether it is a case of fraud, a business dispute, a contract compliance issue, a regulatory enquiry or sizeable transaction, serious issues can quickly crop up, spiral out of control and cause substantial damage. We combine the best forensic skills in the market with our team of accountants, investigators, economists, technology specialists, ex-law enforcement professionals and regulators.

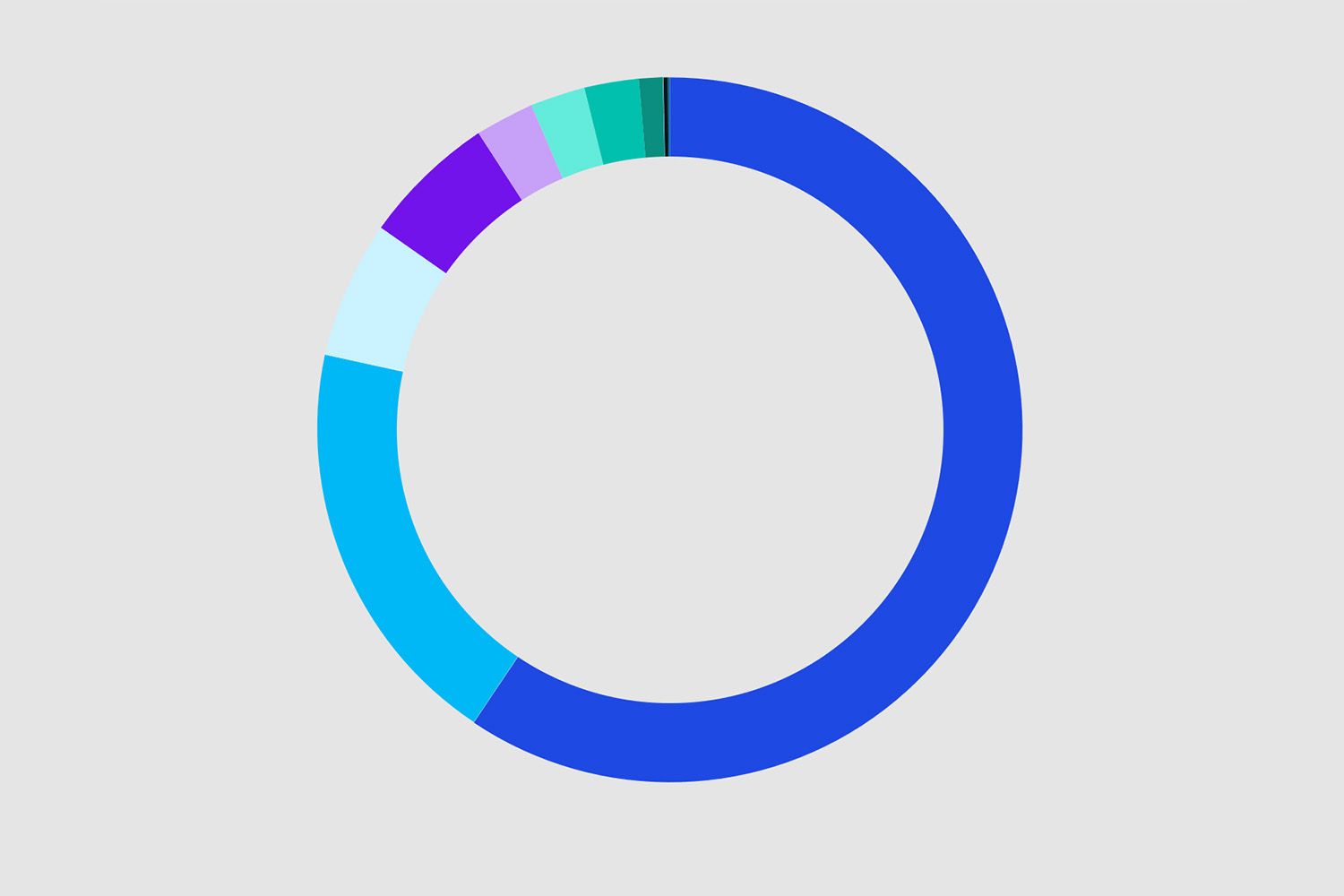

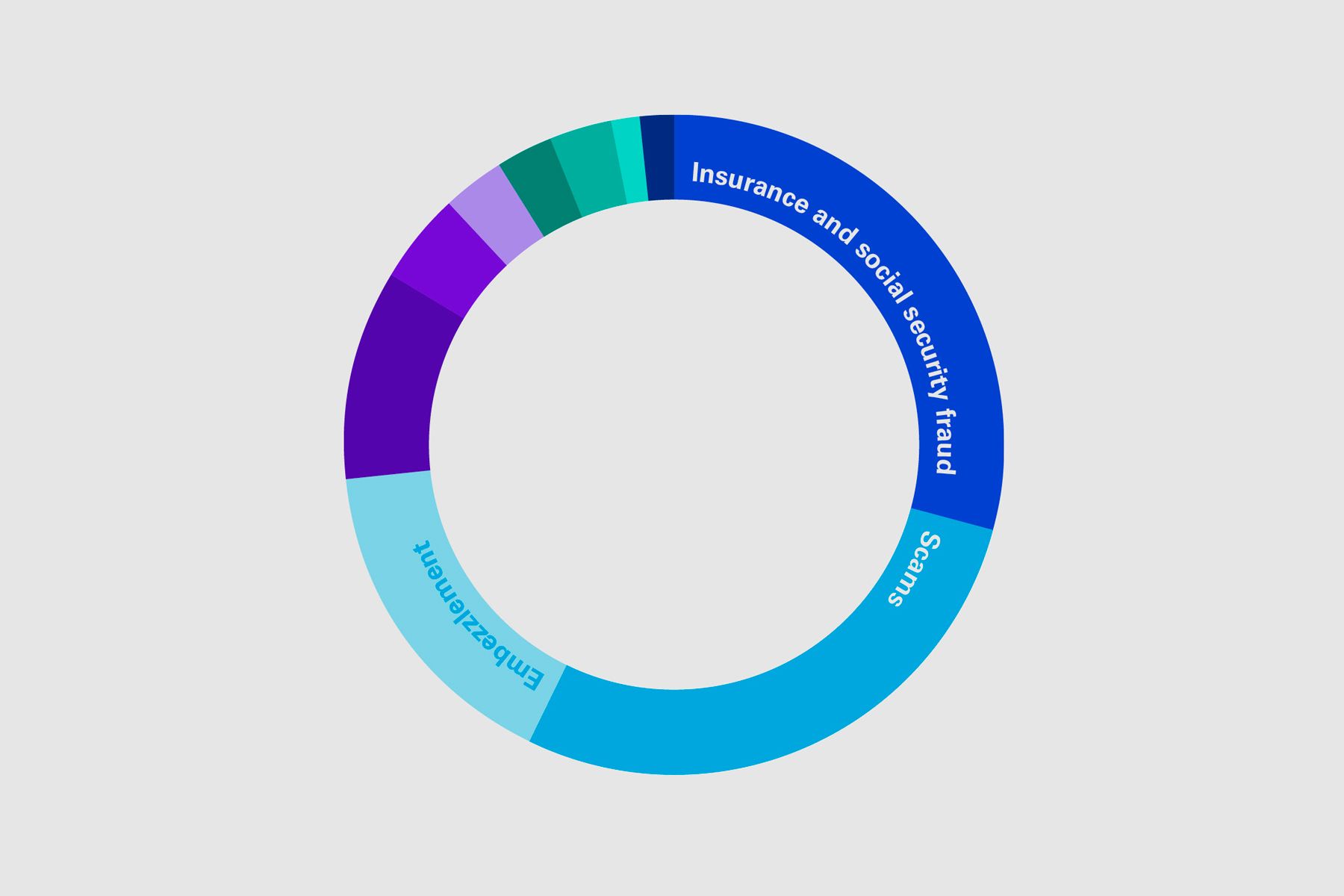

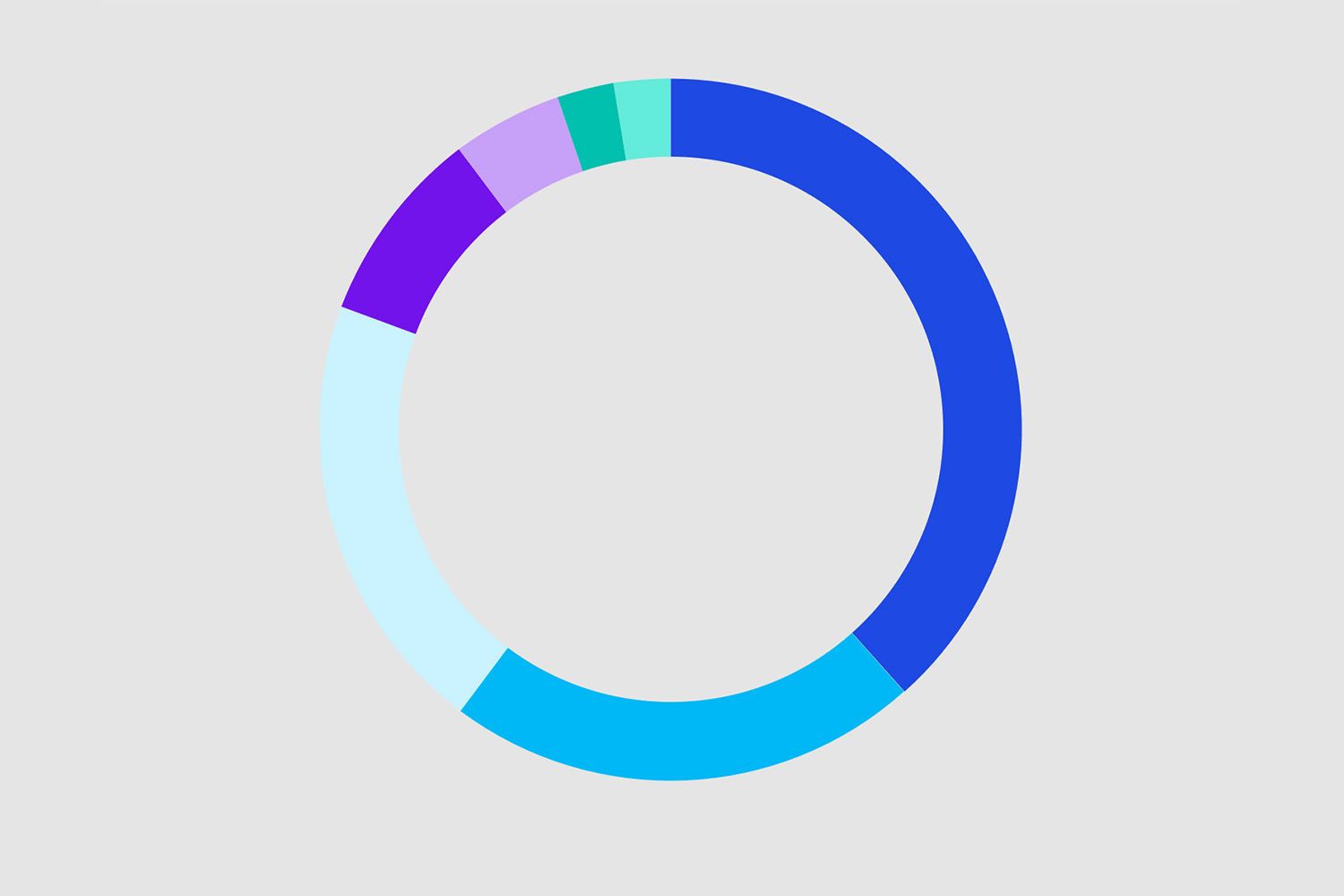

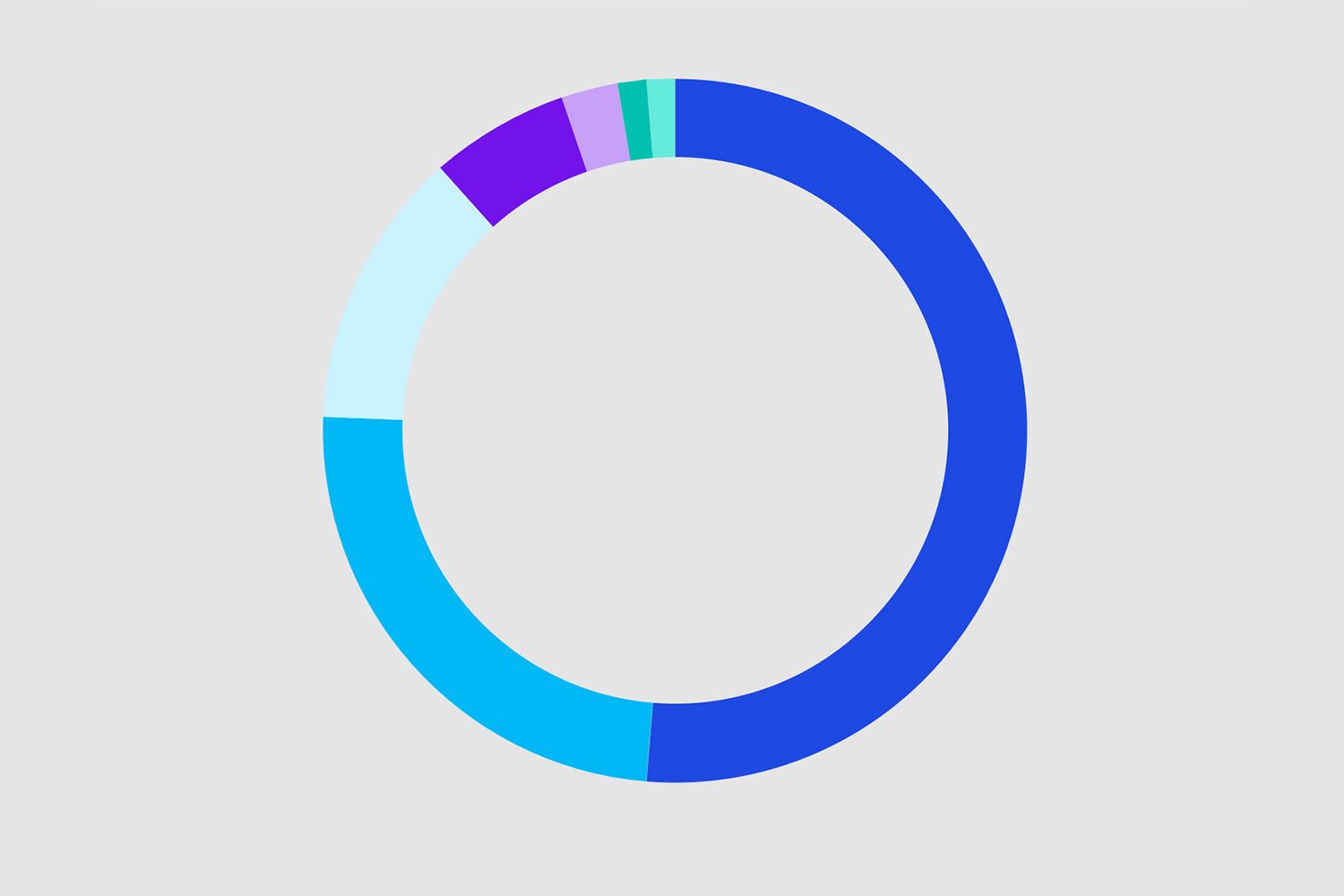

Forensic Fraud Barometer 2023

The latest results of the KPMG Forensic Fraud Barometer cover fraud cases in Switzerland in 2022. The Barometer tracks fraud cases and summarizes fraud types that have dominated Swiss courts. The review identifies the latest fraud trends and patterns affecting Switzerland’s economy, thus helping businesses to remain alert to new threats and respond to any fraud risks in an appropriate and proactive manner.

KPMG's expertise

Our extensive network of forensic experts can help you identify, mitigate and take into account future risks to your organization. From keeping you up-to-date on regulatory changes to investigating and dealing with disputes when they do arise.

Latest insights & featured content

Read our latest insights and find out more about related services .

Your key contacts

Discover more

Cyber & Digital Risk Consulting

We support clients across industries to be safe, from business strategy to bits & bytes. If an incident strikes, we help respond and recover swiftly.

KPMG Powered Enterprise

KPMG's Powered Enterprise is a transformation solution that supports organizations towards sustainable change.

KPMG Blog

Our blog offers a clear picture of current trends and challenges facing the Swiss economy.