Corporate Tax

Corporate Tax

Unternehmenssteuern sind zentraler Bestandteil der finanziellen Unternehmensführung. Die Steuerplanung muss Teil der Geschäftsstrategie sein.

Unternehmenssteuern sind zentraler Bestandteil der finanziellen Unternehmensführung.

Bei der Erarbeitung von Steuerkonzepten und –strategien für national und international tätige Unternehmen ist die umfassende Kenntnis des Unternehmens die notwendige Basis. In enger Zusammenarbeit mit dem Management beurteilen die Berater von KPMG die gesamte Steuersituation und erstellen die Grundlagen für ein nachhaltiges Tax Management. Dank der multidisziplinären Vorgehensweise und einem ständig aktualisierten Wissenstransfer kann Ihr Unternehmen in jeder Situation steuerkonform handeln, auf Veränderungen flexibel reagieren und Steuervorteile nutzen. Wesentliche Voraussetzung für die steuerliche Optimierung ist die gezielte Unterstützung bei den täglich sich ergebenden Fragestellungen.

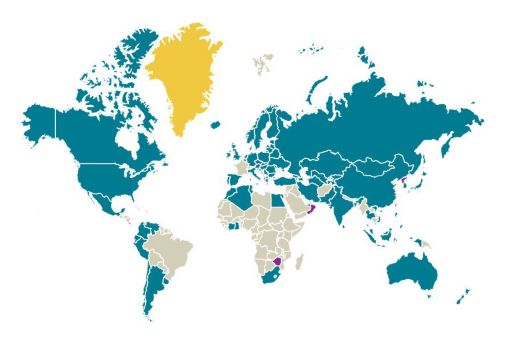

Die Steuerberater von KPMG sind mit nationalem und internationalem Steuerrecht vertraut und stets auf dem neusten Wissensstand. Dank der Präsenz von 13'000 Steuerberatern in 106 Ländern gehört KPMG zu den wenigen Ansprechpartnern, die Ihnen ihr spezifisches Wissen weltweit anbieten können. Die Berater arbeiten in Teams, welche im Hinblick auf die Bedürfnisse der Kunden zusammengestellt werden. Sie verfügen über ein klares Verständnis der Steuergesetze und zahlreicher Geschäftsbereiche. KPMG hält die Kunden und Fachleute mit aktuellen Steuernachrichten und technischen Entwicklungen der internationalen Kompetenzzentren und nationalen Steuerbüros auf dem Laufenden.

Expertise von KPMG

- Erstellung von Steuererklärungen und Steuerbilanzen für nationale und internationale Unternehmen verschiedenster Rechtsformen

- Entwicklung von steuerlichen Optimierungen zum Beispiel bei Umstrukturierungen und Transaktionen

- Begleitung bei Betriebsprüfungen

- Vertretung gegenüber Finanzbehörden

- Erstellung der Finanzbuchhaltung, des Jahresabschlusses sowie Reportings nach nationalen und internationalen Rechnungslegungsvorschriften

- Unterstützung bei spezifischen Steuerfragen wie beispielsweise Lohn- und Spesenbezügen oder Nachfolgeregelungen

- Spezielle Methodik für Wertschöpfungskettenanalysen (VCA) zur Erkennung und Definition wertschöpfender Massnahmen, Personen und Standorte, einschliesslich DEMPE-Analyse für die IP-Planung

Weitere Informationen

STAF Impulssheet (PDF)

Von der ESTV akzeptierte Zinssätze 2024 (PDF, auf Englisch)

Steuerrecht des Kantons Zug (PDF)

Mehr Rendite = Mehr Rente (PDF)

So kontaktieren Sie uns

- KPMG Standorte finden kpmg.findOfficeLocations

- kpmg.emailUs

- Social Media @ KPMG kpmg.socialMedia