Das Projekt zur Verkürzung und Verlagerung von Gewinnen (Base Erosion and Profit Shifting (BEPS)) der OECD zur Bewältigung der steuerlichen Herausforderungen, die sich aus der Digitalisierung der Wirtschaft ergeben, führte zu einem Zwei-Säulen-Ansatz:

- Säule 1 richtet die Besteuerungsrechte stärker auf das lokale Marktengagement aus und verwendet keine physische Präsenz als Nexus.

- Säule 2 ist die Vereinbarung über eine weltweite Mindestbesteuerung von 15%.

Die Säule 2 ist für Konzerne relevant, die in mindestens zwei der vier vorangegangenen Geschäftsjahre in ihren konsolidierten Jahresabschlüssen einen Jahresumsatz von EUR 750 Mio. oder mehr ausgewiesen haben. Wenn Ihre Unternehmensgruppe diese Schwelle nicht erreicht, sollten Sie dennoch unter Berücksichtigung der Eigentümerstruktur prüfen, ob sie gegebenenfalls Teil einer grösseren Gesellschaft/Gruppe mit Konsolidierungspflicht (z. B. Family Office. Stiftung usw.) ist.

Sowohl an Säule 1 als auch an Säule 2 wird derzeit gearbeitet, wobei Säule 2 bereits weiter fortgeschritten ist. Die ursprünglich für 2023 vorgesehene globale Mindeststeuer der Säule 2 dürfte sich allerdings noch etwas verzögern. Obwohl noch einige Fragen offen sind, deuten die internationalen Entwicklungen darauf hin, dass die Säule 2 in vielen Ländern - einschliesslich der Schweiz - Anfang 2024 umgesetzt werden soll.

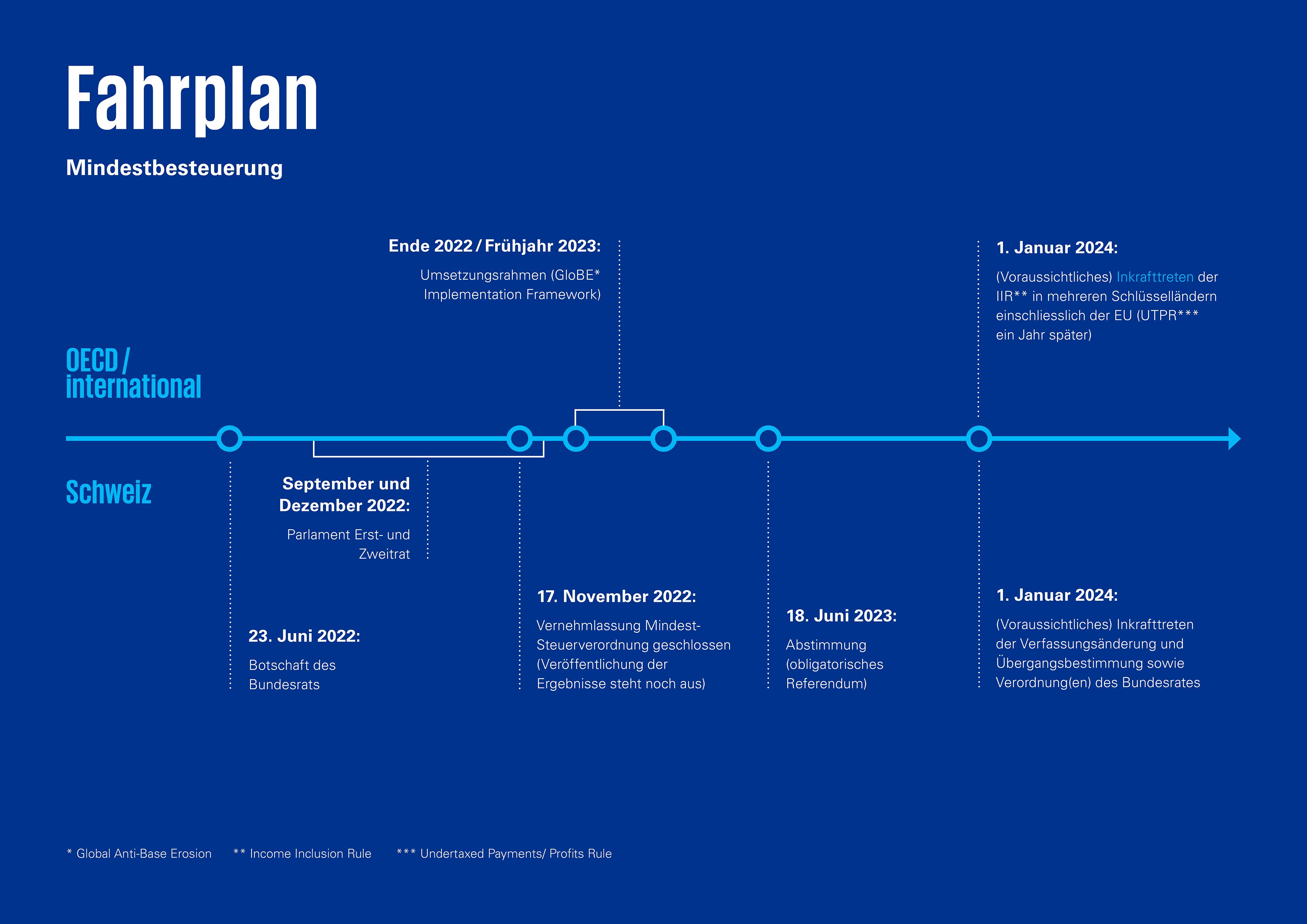

Zeitplan Schweiz und OECD für Säule 2

Die Schweiz hat bereits wesentliche Schritte unternommen und dürfte somit den Zeitplan der OECD für die Einführung der globalen Mindeststeuer einhalten.

Das Konzept von Säule 2 wird von mehr als 100 Ländern weltweit umgesetzt. Ihre jeweiligen Melde- und Compliance-Pflichten richten sich nach dem geplanten Zeitpunkt der Umsetzung.

Auch wenn für eine kleine Zahl von Ländern noch einige Unklarheiten bestehen, scheint es wahrscheinlich, dass die meisten Länder – einschliesslich der Schweiz – die Säule 2 für Geschäftsjahre umsetzen werden, die am oder nach dem 31. Dezember 2023 beginnen. Das heisst, Sie müssen in der Lage sein, die mögliche zusätzliche Steuerlast ab 2024 zu quantifizieren und zu melden. Bis dahin müssen die entsprechenden Governance-Regelungen, Verfahren und Systeme eingeführt werden.

Die meisten multinationalen Konzerne werden ihre erste Steuererklärung nach Säule 2 wahrscheinlich im Juni 2025 oder später einrichten müssen. Allerdings sollten Unternehmen sich darüber im Klaren sein, dass Investoren eventuell Angaben zu möglichen Auswirkungen erwarten, bevor die Änderungen an der lokalen Steuergesetzgebung abgeschlossen sind.

Wenn Sie unter der globalen Mindestbesteuerung mit wesentlichen Auswirkungen auf Ihr Unternehmen rechnen und diese Informationen für die Empfänger Ihrer Jahresabschlüsse relevant sind, sollten Sie in Ihrem Geschäftsbericht 2022 gegebenenfalls entsprechende Angaben machen.

Weitere Informationen dazu finden Sie hier: Zusätzliche globale Mindeststeuer unter BEPS 2.0 (auf Englisch).

Welche Informationen müssen Sie sammeln?

Die von der OECD für die Säule 2 veröffentlichten GloBE-Musterregeln sehen die Verwaltung von rund 150 verschiedenen Datenpunkten und Wahlmöglichkeiten vor. Wir verfügen über einen bewährten Zuordnungsansatz, der es ermöglicht, die GloBE-Regeln mit den in Ihrer Organisation vorhandenen Daten abzugleichen. Dazu bieten wir einen ganztägigen «Discovery Workshop» an, um Sie bei der Ermittlung der relevanten Daten in Ihren Systemen und Ihrer Datenlandschaft zu unterstützen.

Sie werden entscheiden müssen, ob Sie ein eigenes Berechnungsverfahren für Säule 2 entwickeln, eine Lizenz für ein bereits erhältliches Produkt erwerben oder die Berechnung an einen externen Anbieter auslagern möchten.

Das BEPS 2.0 Modell von KPMG wurde entwickelt, um die Auswirkungen von Säule 2 auf Ihren Konzern zu modellieren – in Abhängigkeit von den jeweiligen spezifischen Umständen (siehe auch unten).

Die Phasen des KPMG Projektansatzes

Unser Projektansatz hilft Ihnen Schritt für Schritt, sich auf die Anforderungen von Säule 2 vorzubereiten – und zwar unabhängig davon, in welcher Phase der Implementierung Sie sich derzeit befinden.

Phase 1: Kick-off

Zunächst stimmen wir uns betreffend aktuellen Stand und Zeitplan ab und legen dann die relevanten Personen und Teammitglieder fest.

Phase 2: Analyse

Wir helfen Ihnen bei der Bestimmung von Pilotländern/-organisationen für die Datenzuordnung und führen eine erste relevante Folgenabschätzung (Berechnung) durch. Dabei kommt gegebenenfalls das BEPS 2.0 Modell von KPMG zum Einsatz.

Phase 3: Auswahl

Hier geht es um die Definition und Strukturierung von Prozessen, einschliesslich Bestimmung des nötigen End-to-End-Datenmanagements und Auswahl einer geeigneten Technologie.

Phase 4: Umsetzung

In diesem Schritt konzentrieren wir uns auf Compliance-Anforderungen und auf die Implementierung der Technologien.

Kontaktieren Sie unsere Experten

Unser Expertenteam hat Erfahrung bei der Begleitung von Unternehmensgruppen durch den Umsetzungsprozess. Wir unterstützen Ihr BEPS Säule-2-Projekt:

- Individuell, je nach Ihren Anforderungen, Ihrem Zeitplan und Ihren internen Fähigkeiten und Kapazitäten

- Unter Berücksichtigung der KPMG Projektmethodik für BEPS Säule 2

- Mit Zugang zur globalen BEPS Säule-2-Arbeitsgruppe von KPMG sowie unseren gesamten Erkenntnissen aus der Interpretation der Modellregeln, aus Best Practices und Technologien