Wir unterstützen Finance und HR Leaders bei der Weiterentwicklung ihrer Funktionen. Mit einer strukturierten Methodik begleiten wir Unternehmen bei der Gestaltung eines effizienten und serviceorientierten Betriebsmodells, um Finance und HR als marktorientierte Partner des Business zu positionieren. Wir begleiten unsere Mandanten von der Strategiestudie über die Konzeption bis zur Implementierung der Optimierungsmassnahmen.

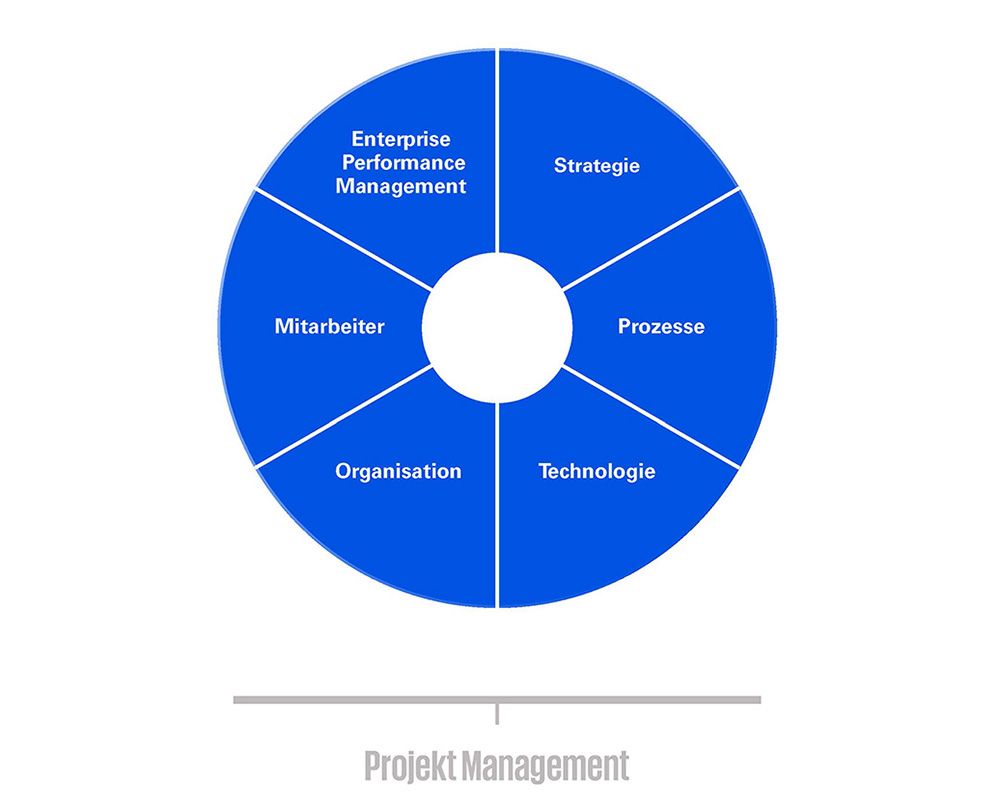

Unser Service Portfolio

Bewertung und Benchmarking der Finanzfunktion sowie Roadmap zur Transformation der Finanzfunktion.

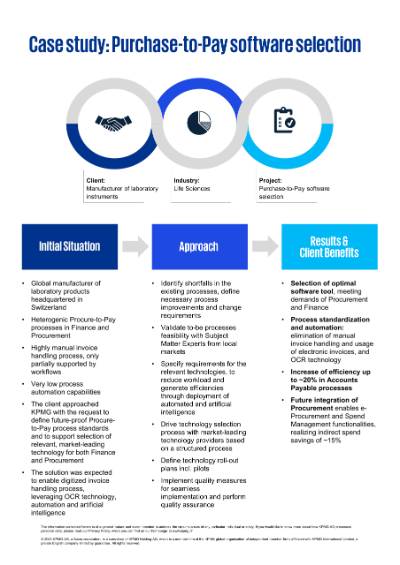

Standardisierung von P2P-, O2C-, R2R-Prozessen sowie Prozessdokumentation und Compliance.

Automatisierung durch RPA und Workflows sowie Auswahl von Automatisierungswerkzeugen und Anbietern.

Zentralisierung mit Shared Service Center und BPO sowie Auswahl von Outsourcing-Anbietern.

Definition von relevanten Rollenprofilen und Ermöglichen von Business Partnering.

Definition der Performance-Steuerungslogik und Einrichten von Reporting- und Konsolidierungswerkzeugen.

Partnerschaften

Neueste Publikationen

Entdecken Sie die Wahrheit über die Finanzplanung und Budgetierung mit Insights aus unseren Interviews mit Schweizer Finance Leaders. Wir enthüllen Mythen versus Realitäten und zeigen Ihnen auf, welche Massnahmen ergriffen werden können, um Ihre strategischen und funktionalen Planungsprozesse sowie die Erkenntnisse für Finanzen und die Organisation zu verbessern. Lesen Sie mehr dazu in unserem Artikel.

KPMG hat CFOs führender Schweizer Unternehmen befragt, wie sie die Rolle der Finanzfunktion bei der Wertschöpfung sehen. Laden Sie die Publikation herunter und entdecken Sie wichtige Erkenntnisse für Ihre eigenen Überlegungen.

Referenzen

Eine Auswahl unserer Kundenprojekte.

Erfahren Sie mehr

Interessant für Sie:

Sehen Sie sich unsere neusten Videos an

Erfahren Sie mehr über unsere Mitarbeitenden und deren Tätigkeiten.

Entdecken Sie mehr

KPMG Powered Enterprise

Transformationslösung, die Unternehmen auf dem Weg zum nachhaltigen Wandel unterstützt.

Finanzfunktion der Zukunft

Prozessdesign als Erfolgsfaktor für die Finanzfunktion der Zukunft.

Rechnungswesen und Lohnbuchhaltung

Wir stärken die organisatorischen Abläufe Ihres Unternehmens.

Digitaler Finanzabschluss

Wie Unternehmen durch Einsatz von Technologie den Record to Report Prozess verbessern können.