The President of the United Arab Emirates, H.H. Sheikh Mohamed Bin Zayed Al Nahyan has issued the Federal Decree-Law No. (47) of 2022 on the Taxation of Corporations and Businesses (“CT Law”) on December 9, 2022. The CT Law has dedicated specific provisions pertaining to the Oil & Gas and other Natural Resources sector which we have set out in this Tax Flash. For a detailed description of the key elements of the CT Law please refer to KPMG’s previous tax flash: Tax Flash - KPMG United Arab Emirates (home.kpmg)

The CT Law will be effective for financial years starting on or after 1 June 2023. The CT Law co-exists alongside the corporate tax regime applicable under the Emirates Tax Decrees. The income derived from the Extractive Business or Non-Extractive Natural Resource Business shall continue to be calculated and taxed by the respective Emirate Tax Decree.

The CT Law stipulates that any income derived from Extractive Business (Article 7) and Non-Extractive Natural Resource Business (Article 8) shall be exempt from corporate tax provided certain conditions are met. However, income derived from other business activities shall be subject to corporate tax. These provisions are further explained in section 2 of this tax flash.

Companies in scope will need to review whether their income qualifies for the exemption.

We have summarized the key clauses of Article 7 Extractive Business and Article 8 Non-Extractive Natural Resource Business.

1. The CT Law definition of an Extractive Business and Non-Extractive Natural Resource Business

Expression |

Definition |

Natural resources |

Water, oil, gas, coal, naturally formed minerals, and other non-renewable, non-living natural resources that may be extracted from the state’s* territory. |

Extractive business |

The business or business activity of exploring, extracting, removing, or otherwise producing and exploiting the natural resources of the state or any interest therein as determined by the minister. |

Non-extractive natural resource business |

The business or business activity of separating, treating, refining, processing, storing, transporting, marketing or distributing the natural resources of the state. |

* State is defined as the United Arab Emirates.

2. Key Provisions of an Extractive Business and Non-Extractive Natural Resource Business as per the CT Law.

- The provisions of the CT Law shall not apply to the Extractive Business or Non-Extractive Natural Resource Business carried out by a Person, where all the following conditions are met:

- The Person directly or indirectly holds or has an interest in a right, concession or license issued by a local government to undertake its Extractive Business;

- The Person is effectively subject to tax under the applicable legislation of an Emirate in accordance with the provisions of Clause 6 of this Article; and

- The Person has made a notification to the Ministry in the form and manner agreed with the Local Government.

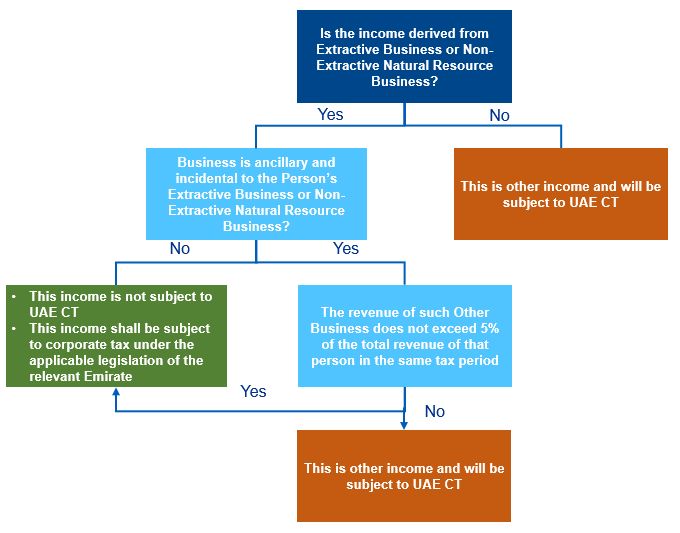

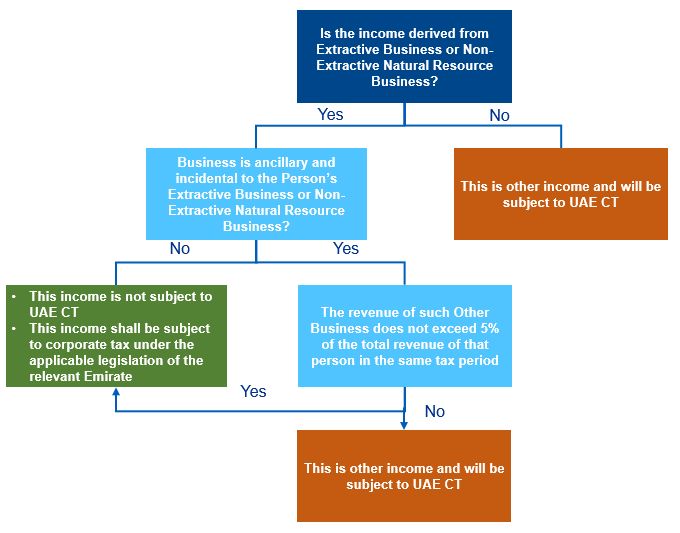

- Any income derived from other business activities shall be subject to the normal CT regime. Other Business as referred to in the CT Law is a:

- A business that is not ancillary or incidental to that Person’s Extractive Business/Non-Extractive Natural Resource Business; or

- A business is ancillary or incidental to that Person’s Extractive Business/Non-Extractive Natural Resource Business and the Revenue of such other Business in a Tax Period exceeds 5% (five percent) of the total Revenue of that Person in the same Tax Period.

- The Other Business shall be treated as an independent business with the requirement to prepare and keep financial statements for this Business separate from the Extractive Business/Non-Extractive Natural Resource Business.

- Any common expenditure shared between the Extractive Business and the Other Business of the Person shall be apportioned in proportion to their Revenue in the Tax Period.

- Transactions between the Extractive Business/Non-Extractive Natural Resources Business and the Other Business of the same Person shall be considered as a Related Party transaction according to the CT Law and will need to comply with the Arm’s Length Principle (Article 34).

- The CT exemption shall not apply to contractors, subcontractors, suppliers or any other Person used or contemplated to be used in any part of the performance of the Extractive Business or Non-Extractive Natural Resources.

Flowchart tax classification of Extractive Business and Non-Extractive Natural Resource Business

3. Applicable legislation of the relevant Emirate

The production and exploitation of oil, natural gas, water, and other natural resources make up an important part of the UAE’s economy. Companies engaged in the Natural Resource Business under concession agreements, are subject to income tax per the respective Emirate Tax Decree as listed below:

- Abu Dhabi Income Tax Decree of 1965 (as amended by Decree 4 of 1972)

- Dubai Income Tax Decree of 1969

- Sharjah Income Tax Decree of 1968

- Ras Al Khaimah Income Tax Decree of 1969

- Fujairah Income Tax Decree of 1966

- Ajman Income Tax Decree of 1968

- Umm Al Quwain Income Tax Decree of 1968

Each of the seven individual Emirates that constitute the UAE are responsible for the regulation of Natural Resources sector within their own territory. In most of Emirates, taxable income is subject to progressive rates of up to 55% under the relevant Income tax Decree. However, Foreign concession holders who are engaged in the extraction of Oil and Gas are typically taxed at different tax rates and provisions agreed with the relevant authority under specific government agreements/fiscal letters in practice.

Contact us

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today