Studies have shown that the world needs to invest an average of USD 3.7 trillion annually through 2035 (USD 69.4 trillion from 2016 to 2035) in infrastructure finance to support currently expected rates of growth. Financing is needed for a variety of purposes, including roads, rail, ports, airports, power, water, and communications infrastructure. If the current trajectory of underinvestment continues, the world will fall short by roughly 11%, or USD 350 billion a year. The size of the gap triples if the additional investment required to meet the new UN Sustainable Development Goals is included.[1]

However, adequate capital can be sourced: investors prove exceedingly keen to finance the rare infrastructure deals that they consider “bankable”, and that have optimum risk-return profiles.[2] Research shows that by scaling up best practice in selecting and delivering new infrastructure projects, and getting more use out of existing infrastructure, governments could obtain the same amount of infrastructure for 40% less. This would be the equivalent of a saving of USD 1 trillion a year.[3] There may therefore be adequate capital available to meet global infrastructure requirements, but insufficient risk mitigation often hampers projects’ ability to achieve financial closure.

Financing for projects may be derived from either debt or equity. Equity is provided by project sponsors, governments, third-party private investors, and internally generated cash.

Usually debt finance makes up the majority share of investment needs in projects, and can include commercial loans, bridge finance, bonds and other debt instruments (for borrowing from the capital market), and subordinate loans. These can come from conventional banks, pension funds, infrastructure funds, export credit agencies and project bonds – a significant amount flowing in from government privatizations.

There is a shift taking place in the structure of project financing due to Basel 4 and IFRS 9 regulations, although bank finance will continue to be important. In the future, infrastructure funds and pension funds are more likely to directly finance projects as they are cost effective and represent a good liability-asset match. This is a healthy transition as it is likely to better serve the world's infrastructure needs.

“In the future, infrastructure funds and pension funds are more likely to directly finance projects as they are cost effective and represent a good liability-asset match.”

Compliance with Basel 4 requirements will increase the loan interest-rate spread and will discourage long-term lending by financial institutions with majority short-term liabilities. Usually, banks limit loans to corporates with tenors of to five to eight years, but with project finance deals, they could go up to 15 to 20 years. Whilst project finance loans from banks will continue to play an important part, liquidity will be available from infrastructure funds, export credit agencies and project boards. Instruments that provide political risk cover from institutions like MIGA and EIB can be used to elongate tenor of project finance loans/bonds.

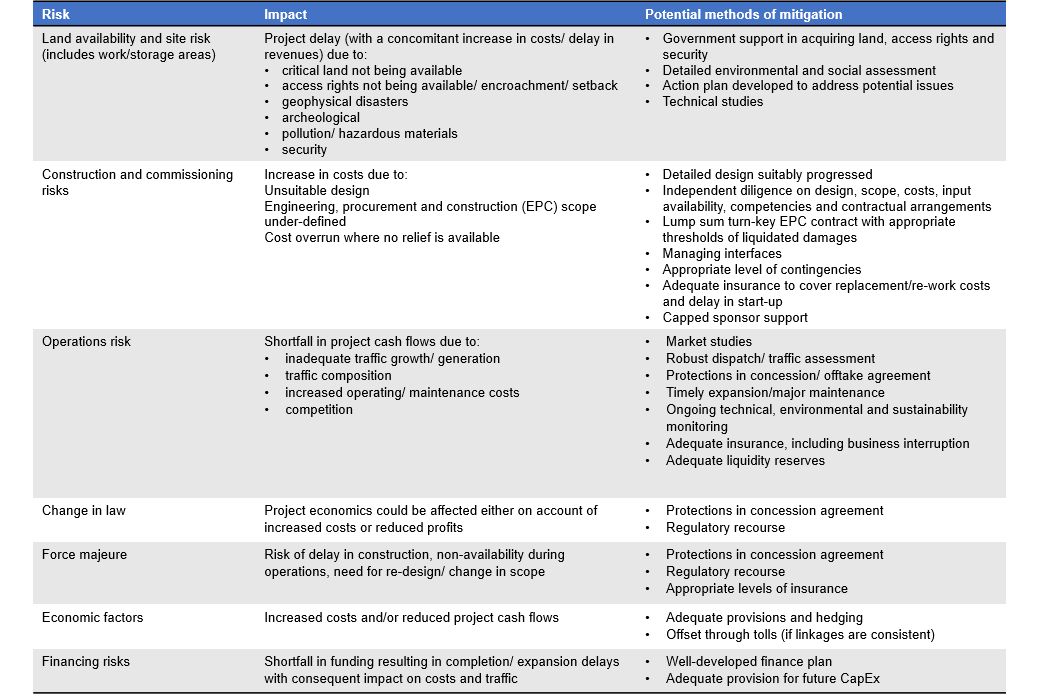

On a global scale, it appears that the main issue is not that there is not sufficient capital available for infrastructure. Rather, projects are frequently not completed satisfactorily due to incorrect risk allocation. Risk mitigation broadly consists of four main tiers:

- correct unbundling of infrastructure

- consideration of regulations and public policy

- appropriate financing at project level

- mitigating technology risk (this will be discussed in our next insight)

The importance of correct unbundling

Unbundling involves breaking up the individual elements of the infrastructure chain into those that are monopolistic in nature – which require regulation – and those that fall under the umbrella of a free market. Incorrect unbundling, which often leads to regulating the wrong element of the chain, can have unfavorable consequences, and has been the downfall of numerous privatization schemes. For instance, the power sector can broadly be split into generation, transmission and distribution. In most cases, the three components are controlled by one organization—a government entity. Privatizing it would initially require breaking up the process into disparate elements (unbundling). The nature of each component must subsequently be analyzed to determine the extent of regulation it requires. In this example, the transmission sector necessitates the most regulation as it is monopolistic in nature and capital intensive. Generation, however, is significantly less capital intensive, so a free market approach is considered more appropriate.

Once authorities have determined what should be unbundled, they must ask themselves how the unbundling should be carried out. There are two main methods: vertical and horizontal. Vertical unbundling is simply the separation of functions, as in the example above. The United Kingdom, for example, implemented vertical unbundling when it privatized its rail sector, allocating train tracks across the entire network to one operator, signaling to another, and rolling stock to yet another (or multiple along geographical lines). This resulted in poor operating efficiencies and multiple accidents, as often the rolling stock operators tended not to fully cooperate with the track or signals operators.

The horizontal method is a topographical separation: all functions within a particular area are controlled by a single entity, with another entity controlling all functions in a different geographical location. Japan and Argentina opted for this when they overhauled their railway systems with structural reforms. The outcome of each scenario seemed to indicate that horizontal unbundling may generally be more effective. It is safer for the power sector, especially for the generation component. Transmission, however, can be vertical, as power lines run continuously across large swathes of land and an excess of interface transfer costs could cause administrative complications.

Regulatory considerations

Monopolistic elements of the chain are those that require regulation, in other words where the barriers to entry are high. Regulation may take one of two forms: US cost-push inflation, and price-cap regulation. With the cost-push inflation method, the capital cost of the entity is calculated and the return is determined. This method can be fraught with problems, however, regarding the factors that influence arriving at the cost of capital, which may be subject to over-exaggeration. Regulators can remain locked in a continuous battle, trying to reduce the estimated cost of capital, while the accuracy of the calculated return may be hotly debated by the operators’ lawyers and accountants. Cost-push inflation occurs when supply costs rise or supply levels decrease, driving up prices if demand is a constant. Meanwhile price-cap regulation, or CPI-X, subtracts the expected efficiency savings from the rate of inflation, measured by the Consumer Price Index (CPI). As the CPI takes into consideration a wide range of organizations within the economy, it is a valid comparative measure, and the preferred method of regulation in most jurisdictions.

Before capital is deployed, it is imperative that unbundling is carried out astutely and appropriate regulations are imposed on relevant elements of the chain: several privatization ventures fail entirely due to injudicious unbundling.

Governments must perform value-for-money calculations to assess whether privatization would be financially viable and advantageous, and analyze efficiencies, including the cost of capital, to determine whether monetary value is created for the government. However, the story does not end here. Besides pecuniary considerations, the ‘true value of the project should be analyzed: what is the environmental and sustainability impact of the project? Every privatization initiative has winners and losers; true value for money captures this. KPMG Global defines it as “a tool to understand how the value a business creates and reduces for society is likely to affect the value it creates for shareholders.”[4]

Project financing through special purpose vehicles (SPVs)

Legislation may be drawn up once the value for money and true value are deemed adequate. After the macro privatization principles are understood and applied, the company typically forms SPVs to contend with different elements of risk, for instance construction risk or operation risk: a competent building contractor would be allocated a lump sum turnkey EPC (engineering, procurement and construction) contract, while the operations component of the business would be managed via an agreement with a specialized operator.

Project finance is a form of secured lending, and typically has carefully considered risk allocation arrangements. Lenders give credit to a project company with a low asset value, that tends to be a legally independent special purpose vehicle set up by the project sponsor. Inputs are sourced and processed, and the outputs are products that are sold and off-taken. Revenue allocation is then carried out, usually to operating costs and debt service.

The SPV has no other purpose but to own and borrow the funds to construct the project and has no pre-existing business record. It then subcontracts construction and operations. Risk will be higher during the construction phase as revenue streams have not yet come in, which is often the case for a power-purchase or offtake agreement. The debt and equity used to finance the project are paid back from the cash flow generated by the project.

This all falls under the umbrella of limited or non-recourse finance (NCF). NCF is a type of commercial lending that entitles the lender to repayment only from the profits of the project the loan is funding and not from any other assets of the borrower. It is usually secured by collateral. In case of default, the lender may not seize any assets of the borrower beyond the collateral.[5]

A debtor with a non-recourse loan cannot be imposed upon for additional payment beyond the seizure of the asset. The only type of breach of covenant which would lead to lenders indeed having recourse to at least part of the shareholders’ assets, would have to be a deliberate breach on the part of the shareholders. Project debt is typically held in a sufficient minority subsidiary that is not consolidated on the balance sheet of the respective shareholders, making it an off-balance sheet item. This reduces the impact of the project on the cost of the shareholder’s debt and debt capacity, freeing it up for other investments. Public sector entities may also use project finance to keep project debt and liabilities off-balance-sheet, using lower levels of fiscal space.[6]

Non-recourse debt often has high capital expenditures, long loan periods and uncertain revenue streams. To preempt deficiency balances, loan-to-value (LTV) ratios are usually limited to 60% in non-recourse loans. Lenders impose higher credit standards on borrowers to minimize the chance of default. They typically carry higher interest rates than recourse loans.[7] The SPV needs to be structured so there is no unallocated residual risk remaining, and the appropriate form of risk is managed by the entity best suited to do so, as reflected in the diagram.

Project counterparties

O and M: operations and maintenance

EPC: engineering, procurement and construction

PPA: power purchase agreement

To summarize, financing projects will only succeed if all the tiers described above have been considered carefully. Unbundling is the keystone: projects will collapse without its effective implementation. The diagram below illustrates the probability of failure if the tenets of the pillars are not implemented efficiently.

| Unbundling | Done well | Done well | Weak | Done well | Done well | Done poorly |

| Regulation | Done well | Done poorly | Done well | Done well | Done poorly | Done poorly |

| Project risk mitigation | Done well | Done well | Done well | Done poorly | Done poorly | Done poorly |

| Probability of default or failure | Very Low | Low | Moderate | High | High | Very High |

In conclusion, focusing on the above three parameters is critical for successfully attracting private capital.

Sources

[3] file:///C:/Users/lmalhotra1/Downloads/MGI%20Infrastructure_Full%20report_Jan%202013.pdf

[4] https://home.kpmg/content/dam/kpmg/ae/pdf/introduction-kpmg-truevalue.pdf

[6] https://ppp.worldbank.org/public-private-partnership/financing/project-finance-concepts